If you have taken the deduction of capital gain in the year of sale of original flat, the construction of…

If your total income taxable in India exceeds Rs 3,00,000; then you would be liable to file income tax return…

The postal department may not have mentioned correct PAN while filing TDS and hence it is not reflected in your…

Normally, interest earned on small savings scheme attract TDS @ 10%.

You can get capital gains tax benefit on investing proceeds in assets held in own name.

Any expenses which are attributable to the purchase of property are allowed to be added in the cost of acquisition…

Income from agriculture is exempt under income tax. However, while computing the tax on total income, it has to be…

Such prize money will be treated as income under Section 56 of the Income-tax Act and shall be classified as…

A deduction under Section 80 TTA up to Rs 10,000 can be claimed against savings account interest, which means that…

Gifts received by a person from his/her relatives who are lineal ascendants and lineal descendants do not attract income tax,…

My wife has a salary income of Rs 10 lakh a year on which she pays tax. Apart from that,…

Immovable property received by way of inheritance is not considered as income of the recepient

As per the provisions of Income-tax Act, 1961, HRA exemption can be claimed only if the rent is actually paid…

Under section 80TTA, a corresponding deduction of such interest income up to Rs 10,000 shall be allowed and hence it…

My National Pension System (NPS) investments will mature next year as I will turn 60. Will PFRDA deduct TDS on…

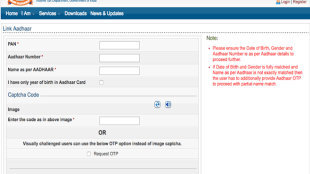

How to link your PAN card with Aadhaar card? Here are easy steps you should follow. Also, July 01 is…

Union Budget 2016: Some unresolved issues like stamp duty and capital gain tax may prove to a roadblock, but the…

Under the I-T Act, 1961, taxpayers are broadly categorised as Ordinary Resident, Not Ordinarily Resident (NOR) and Non-Resident (NR).