-

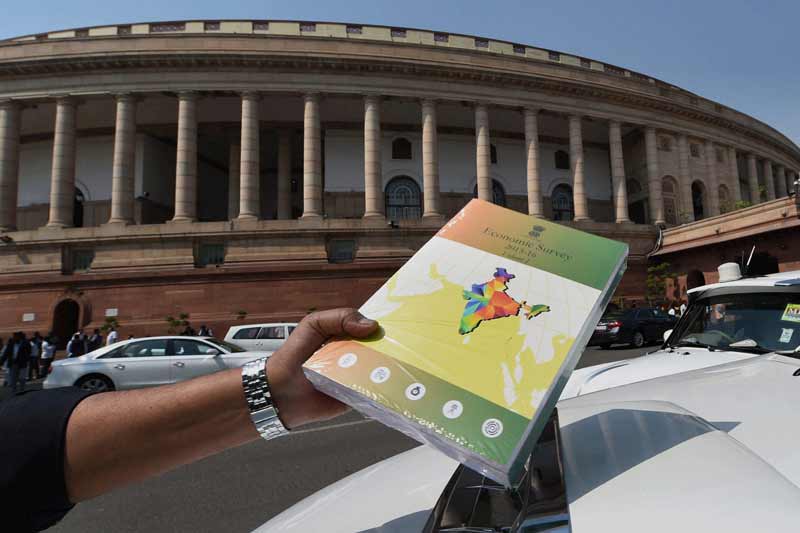

Economic Survey 2016 tabled in Parliament by FM Arun Jaitley today wants to cut subsidies that, as high as Rs 1,00,000 crore, are being cornered by the well-off people in India – recommendations of the Economic Survey have been piloted by CEA Arvind Subramanian, which indicates the direction in which FM would be moving the Union Budget 2016 on Monday, 29th February, 2015. The Economic Survey for 2015-16 also made a case for carrying forward the reform process to achieve macro-economic stability. Here are top 5 key takeaways in Economic Survey about the subsidy for the rich: (Image Source: PTI)

-

The Economic Survey has pointed out: “Subsidies for the poor tends to attract policy attention. But a number of policies provide benefits to the well-off. We estimate these benefits for the small savings schemes and the tax/subsidy policies on cooking gas, railways, power, aviation turbine fuel, gold and kerosene, making assumptions about the definition of “well-off” and the nature of neutral policies. We find that together these schemes and policies provide a bounty to the well-off of about Rs 1 lakh crore.” (Image Source: PTI)

-

The Economic Survey 2016 has highlighted that the policies that are based on providing tax incentives benefit not the middle class ‘but those at the very top end of the income distribution’. The Survey has suggested that the government should move, in a phased manner, to the EET (exempt, exempt, tax) method of taxation of savings. (Image Source: PTI)

-

The Economic Survey 2016; “Interestingly, the New Pension Scheme (NPS) is already being subjected to the EET method of taxation. Therefore, deductions under Section 80C and 80CCD should be re-assessed to move toward a common EET principle for tax savings,” it has stressed.

-

The Economic Survey 2016: The CEA has argued that in many cases, subsidies take the form of explicit subsidization, which is surprisingly substantial in magnitude, and ‘Addressing these interventions and rectifying some egregious anomalies may be good not only from a fiscal and welfare perspective, but also from a political economy welfare perspective, lending credibility to other market-oriented reforms’.