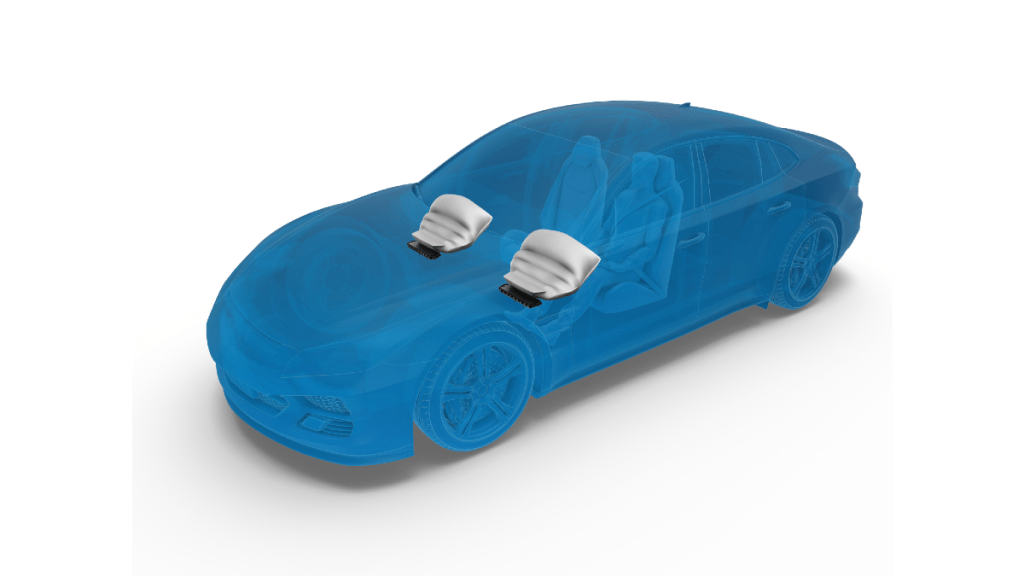

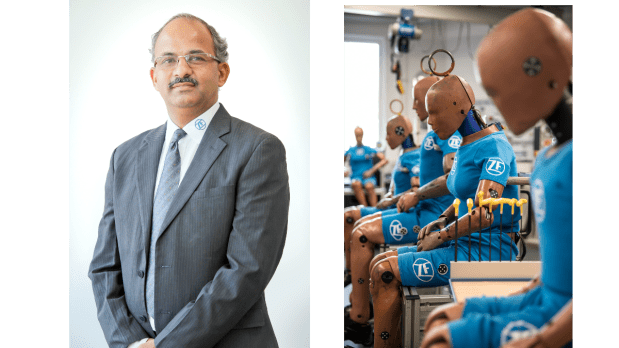

The growing safety consciousness among passengers and the latest Government notification mandating 6 airbags for all new cars from October 2023 and penalising non-usage of seat belts for rear passengers is expected to be a growth driver for relevant component makers. Suresh KV, President, ZF India, with a 30-35 percent airbag market share currently, believes that on the back of this new airbag rule, the company can easily clock in 3x growth.

Justifying the role of strong enforcement and relatively low compliance level, KV strongly elaborates, “We need to have rules and regulations at very high levels, and ensure nothing less than 100% compliance to safety regulations be it wearing seatbelts in the rear seat, usage of helmets for both rider and the pillion, ensuring that there are 6 airbags in the cars as the infrastructure is moving towards high-speed roads. It is no more a desirable activity; it is a necessity.”

He says while on one hand, the road infrastructure is improving significantly and then there is talk about e-mobility, ADAS, and other technological advances, “I think we have to start talking about safe mobility today.”

Economies of scale to rationalise price

He debunks the argument that the cost of putting 6 airbags in every vehicle will make the price of the vehicles a deterrent for the entry-level segment and hence customers will not be able to afford them.

“I feel that as the number of airbags increased and the volume kicks in, the economies of scale kicks in then the costs will have to come down. We need to give a good message to the people that we cannot assess the cost of a life. There is something which has to be considered, even if we are able to reduce casualty by half a percent or 1 percent, I think the entire cost of the airbags will be just paid back if we can avoid it,” adds KV.

Will there be a supply constraint? The company is optimistic. Since the rule will come into effect next year, KV explains that OEMs will have enough time to plan their sourcing strategy. But it also means that some vehicle models will have to be re-engineered and designed, while some maybe forced to retire. ZF India has started seeing RFQ (request for quotation), which eventually will lead to orders.

But will entry-level car buyers be deterred by the price increase and eventually go back to two-wheelers?

KV says, “OEMs cannot shut their eyes towards the demand, and I don’t think an Indian customer will immediately go to a C segment before going through an A & B segment. As the younger generation grows from 20 to 30 years of age. The demand for A & B costs will remain. I think there may be some rationalisation happening there, some customers may decide to pull off, certain models which will help others to consolidate.”

“To that extent, there will be some consolidation and rationalisation, but I strongly believe that that demand will remain and the younger generation who is just passing out their focus towards safety and the orientation towards safety is much better than the previous generation and hence they will also start looking at cars which have these airbags,” concludes KV.