-

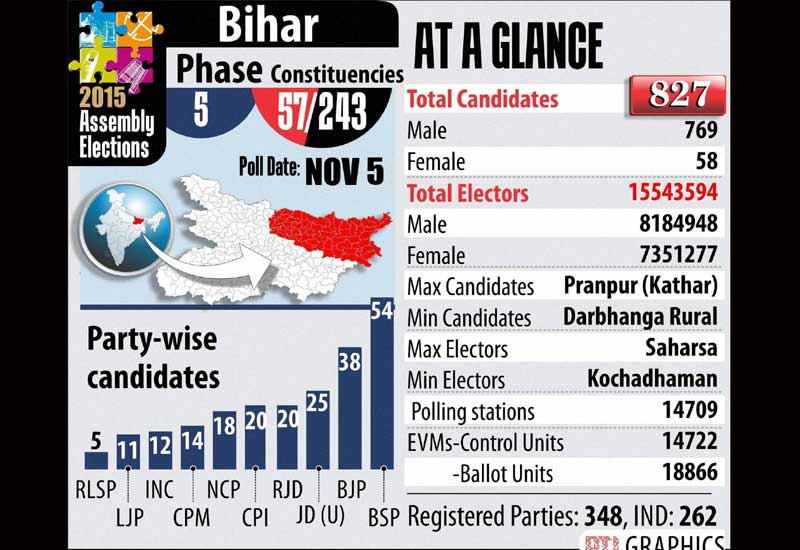

Elections in Indian state of Bihar shaping as a litmus test for investor sentiment, said JP Morgan. A loss by BJP coalition may trigger short-term spike in USD/INR towards 66.5 and would raise fears of a return to more populist policies. On the other hand, a BJP coalition win could be seen as re-igniting reform agenda. But already long positions, means INR would not benefit as much from a BJP coalition win. Bihar set to announce results on Nov 8.

-

Gold prices continued to fall for the fifth straight day and hit over three-week low of Rs 26,700 per 10 grams by losing Rs 110 at the bullion market today, tracking a weakening global trend amid subdued demand from jewellers and retailers. Silver too remained under selling pressure and fell further by Rs 250 to Rs 36,250 per kg.

-

Below the street expectations, Indian Oil Corporation Limited (IOC) on Tuesday reported a net loss of Rs 329.17 crore during the July-September quarter of FY16. The Maharatna had reported net loss of Rs 898.46 crore in the same quarter previous year.

-

The rupee declined by 5 paise to close at one-month low of 65.64 against the US dollar today on fag-end demand for the American currency from banks amidst sustained foreign capital outflows.

-

The 30-share Sensex opened on a firm note at 26,660.71 and advanced further to hit a high of 26,732.24 on value-buying in recently beaten-down stocks.

-

The broad-based NSE Nifty also ended marginally higher by 9.90 points, or 0.12 per cent, at 8,060.70 after breaching the crucial 8,100-level.

-

Reliance Power today reported 36.57 per cent jump in net profit to Rs 345.63 crore for the quarter ended on September 30, on higher electricity generation.

-

Adani Power has reported that its consolidated net loss for the September quarter narrowed to Rs 369.08 crore helped by higher sale of electricity

-

Production and offtake of coal by Coal India Ltd.

-

Consumption of fuel.