-

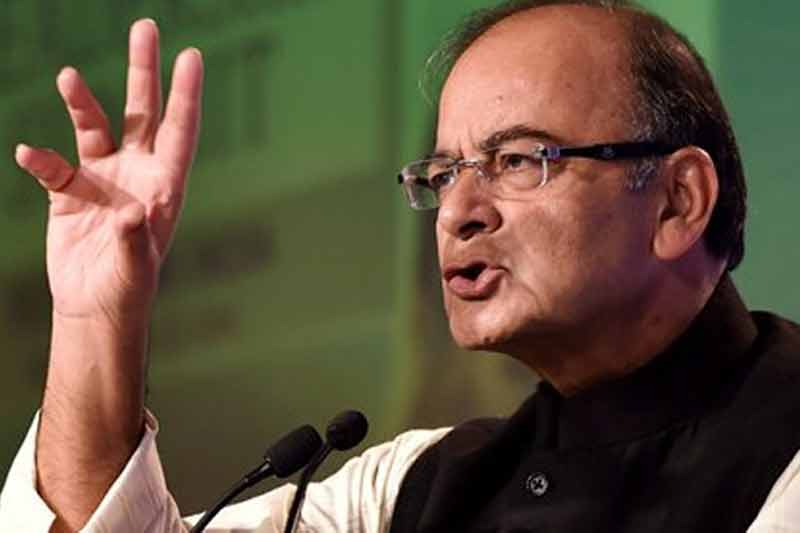

In Budget 2016, Finance Minister Arun Jaitley has cut Tax Deducted at Source (TDS) rates on several deductions, and rationalised others including that of Employees' Provident Fund (EPF), with a view to improve cash flow, especially of small income tax payers. Check out how here:

-

According to the Budget proposal for 2016, the TDS rate in respect of life insurance policies has been reduced from 2 per cent to 1 per cent and on insurance commission from 10 per cent to 5 per cent. Arun Jaitley had that for those 'who get their funds blocked due to current TDS provision', TDS provisions for Income Tax will be rationalied.

-

In Budget 2016 the TDS rate has been halved in case of National Savings Scheme to 10 per cent, and on commission on sale of lottery tickets and other brokerages to 5 per cent. The Budget also proposes to abolish TDS on income in respect of unit and payment of compensation on acquisition of capital assets. (Express photo)

-

16. Income tax exemption limit: Employer contribution in National Pension Scheme (NPS) – Eligible for tax deduction of upto 10% of salary under section 80CCD(2) without any upper cap. It is the best time when investments can still be made and avail tax benefit for the financial year 2015-16 if not done so far. (The author is managing director – Protiviti India, Tax and Regulatory Affairs) (Reuters)

-

The limits for TDS deduction in Budget 2016 have also been raised in case of payments to contractors from Rs 75,000 to Rs 1 lakh, commission or brokerages (from Rs 5,000 to Rs 15,000), commission on lottery ticket (from Rs 1,000 to Rs 15,000) and on acquisition of immovable property (from Rs 2 lakh to Rs 2.5 lakh).

-

9. Income tax exemption limit: Infrastructure Bonds – The investment in infrastructure bonds issued by the infrastructure companies is eligible for deduction under Section 80C.