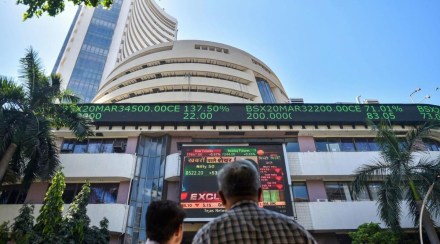

Share Market News Today | Sensex, Nifty, Share Prices Highlights: Benchmark indices ended higher for the second consecutive session boosted by banking stocks post HDFC-HDFC Bank merger news. The Sensex closed 1,335.05 points or 2.25% higher at 60,611.74, and the Nifty shut shop 382.90 points or 2.17% up at 18,053.40. HDFC Bank, HDFC, Adani Ports, HDFC Life and Kotak Mahindra Bank were among the top Nifty gainers. Infosys, Titan Company and Tata Consumer Products were the top losers. All the sectoral indices ended in the green with bank, metal, power, rose 2-3 per cent. In broader markets, BSE Midcap and Smallcap indices rose 1 per cent each.

Benchmark indices ended higher for the second consecutive session boosted by banking stocks post HDFC-HDFC Bank merger news. The Sensex closed 1,335.05 points or 2.25% higher at 60,611.74, and the Nifty shut shop 382.90 points or 2.17% up at 18,053.40. HDFC Bank, HDFC, Adani Ports, HDFC Life and Kotak Mahindra Bank were among the top Nifty gainers. Infosys, Titan Company and Tata Consumer Products were the top losers. All the sectoral indices ended in the green with bank, metal, power, rose 2-3 per cent. In broader markets, BSE Midcap and Smallcap indices rose 1 per cent each.

Benchmark indices were trading near day's high level with Nifty above 18000. The Sensex was up 1,389.37 points or 2.34% at 60666.06, and the Nifty was up 394.70 points or 2.23% at 18065.20.

Shares of Adani Total Gas had hit a new lifetime high of Rs 2,380, up 6 per cent on the BSE in Monday’s intra-day trade. The stock surged 16 per cent in the past six trading sessions after the company announced its foray into electric mobility infrastructure sector. The stock had rallied 50 per cent from level of Rs 1,587 since March, as compared to 7 per cent rise in the S&P BSE Sensex.

“After 45 years in housing finance, after providing 9 million homes to Indians, we have to find a home for ourselves, and we have found a home in our own family company HDFC Bank,” Deepak Parekh said.

Read more

Shares of paper related companies were also in limelight. Genus Paper was locked at the 20 per cent upper limit, while S I Paper soared nearly 9 per cent.

Benchmark indices were trading below day's high. Sensex is up 1,182.92 points or 2.00% at 60459.61, and the Nifty jumped 332.80 points or 1.88% at 18003.30.

Hindustan Aeronautics (HAL) share price hit a record high of Rs 1,592.35, up 4 per cent on the BSE in Monday’s intra-day trade. The stock gained 7 per cent in two trading sessions after the company recorded highest ever revenue of over Rs 24,000 crores (provisional and unaudited) for the financial year 2021-22 (FY22) versus Rs 22,755 crore in FY21, registering 6 per cent on-year growth. The FY22 record-revenue was led by production of 44 new helicopters/aircraft, 84 new engines, overhauling 203 aircraft / helicopters and 478 engines.

HDFC and HDFC Bank’s merger – touted as India's biggest-ever corporate merger – pumped up shares of the two entities on the bourses. Shares of HDFC skyrocketed 16.5 per cent while those of HDFC Bank zoomed 14.3 per cent in intra-day trades. However, analysts say investors need to “tame down” their enthusiasm as the merger might hit regulatory road block, if the Reserve Bank of India (RBI) has its way

“The mega-merger between HDFC ltd into the HDFC bank will enable value unlocking for HDFC bank to build a solid housing loan portfolio and play the housing cycle by enhancing the existing customer base. The merged entity could become the highest weightage single company in the Nifty 50 basket. Further, this merger enables confidence in the Indian economy and looks for a brighter long-term picture beyond the ongoing Russia-Ukraine conflict and the rising inflationary concerns. With this development, today India's VIX fell further by 2.5% to 18 levels vs the long-term average of 22. We believe the next leg of the rally in the benchmark index will be driven by the BFSI space, as banking companies are likely to post solid Q4FY22 earnings, driven by sequential improvement in loan growth. Moreover, the improving asset quality trend will continue for the quarter, bringing further confidence to the space.”

~Naveen Kulkarni, Chief Investment Officer, Axis Securities

Nifty Metal index gained 1 per cent supported by the SAIL, NALCO, Vedanta, Jindal Steel.

HDFC had zoomed to a high of Rs 2,855 post in intra-day trades this morning post announcement of the merger with HDFC Bank. The stock continues to trade with solid gains, albeit off the day's high.

Investors turned wealthier by more than Rs 3 lakh crore in the first hour of trading on Monday as equities rallied on the proposed merger of HDFC Ltd with HDFC Bank. Reflecting bullish investor sentiments, the 30-share key index Sensex skyrocketed 1,472.33 points or a whopping 2.46 per cent to 60,736.08 points at around 10.30 am, driven by HDFC twins.

All HDFC branches will be retained post-merger, while later HDFC branches may be converted into bank branches, said Deepak Parekh. Post-merger, 100% of HDFC Bank will be owned by public shareholders Keki Mistry does not wish to be a full-time executive, but can be on the board, he added.

BSE Capital Goods Index rose 1 per cent led by the Elgi Equipments, Carborundum Universal, Hindustan Aeronautics

Shares of PB Fintech, which has Policybazaar as a wholly-owned subsidiary, soared 9 per cent in early trade on Monday following an upgrade by Morgan Stanley. The global brokerage firm upgraded PB Fintech to 'Overweight' post a sharp correction in the stock although it said that “risks to growth and capital costs for insurance companies are rising”.

The BSE barometer Sensex has fallen nearly 600 points from day's high although it is still up nearly 1000 points and trading firm above 60,000 level. ITC, Asian Paints and Infosys remain top index drags while profit taking in HDFC twins also cut gains.

The merger will be beneficial to both entities and it will strengthen HDFC Bank’s market leadership position. The merger provides the bank with opportunities to pursue growth in the housing finance space where opportunities remain aplenty. 70% of HDFC Bank’s customers without any mortgage products, will now be offered mortgages as a core product in a seamless manner. This will increase the mix of mortgage portfolios from 11% currently to 30+% post-merger. The merger will also enable cross-sell opportunities of the bank’s asset and liability products to HDFC Ltd customers, thus aiding growth over the long term. From a long-term perspective, we believe the shareholders of the bank will gain from the merger.

~Naveen Kulkarni(Chief Investment Officer), Axis Securities

HDFC Bank reported loan growth of 21% year on year and retail deposit growth is healthy. The operating profits may also see a surge on strong commercial banking and corporate segment. The merger of HDFC Bank and HDFC is a complement to the investors and a value addition to HDFC Bank. Ravi Singh, VP & Head of Research, Share India Securities

The deal will bring huge credit growth for the country. For economy, the deal will enable large credit flow, looking at affordable housing, it will provides housing for everyone through low cost funds. The deal is complementary in nature, said said HDFC Bank chairman Atanu Chakraborty. After years of providing homes to our customers we have found home for ourselves in our own HDFC Bank, said HDFC Chairman Deepak Parekh in the press conference.

“The regulatory changes over last 3 years have reduced barriers for a merger. The NPA classification is now the same for NBFC/HFCs & banks and upper layer of NBFCs will have tighter regulations, similar to banks,” said HDFC Chairman Deepak Parekh.

Boards approved all-stock amalgamation of HDFC with HDFC Bank and only after obtaining all regulatory approvals will the merger become effective. Merger will lead to better synergies and returns for the shareholders. Merger will help enhance the market share of the bank, mitigate single product risk, and diversify offerings, said HDFC Chairman Deepak Parekh in the press conference.

This is India's largest and most transformational mergers in the Indian financial services sector. With this merger HDFC Bank gets an unparalleled advantage through the mortgage portfolio providing it a quantum leap in distribution to semi urban and rural areas with a huge opportunity to cross sell bank products to a very very sticky client base. The combined entity will be able to extract substantial synergy benefits which abode well for all stakeholders and shareholder. We are already seeing that in the market reaction to this unprecedented announcement today. Samir Bahl, CEO, Investment Banking at Anand Rathi Advisors

A fresh financial year remains interesting for the Rupee as both domestic and global factors remain shaky and gloomy. Surely, the volatility is likely to remain high as flows will be continuously flinging on and off from EM to DM or US treasuries. The DXY is likely to remain stronger on Fed’s multiple hikes. The commodity market is surely under their bull run and will add another fuel to the ongoing inflationary wave. Higher prices create a headwind in front of net importing nations such as India. Read full story

HDFC Bank has approved merger with HDFC Investments Limited and HDFC Holdings Limited. Post-merger HDFC Limited will hold 41% stake in HDFC Bank. This shall enable the bank to build its housing loan portfolio and enhance its existing customer base. The Bank has also reported robust loan growth in 4QFY22, led by a healthy revival in Retail loans. The Commercial Banking and Corporate segment too saw strong traction, which will likely support growth in PPOP.

We expect the margin trajectory to recover gradually over FY23, while the uptick in Retail loan growth and unsecured products will be supportive of fee income. Trend in Retail deposit too remains healthy, with the bank witnessing a sequential improvement in its CASA ratio to 48%. We maintain our buy rating with a target of Rs 2, 000 per share.

~Motilal Oswal Financial Services

Trading was halted on Sri Lanka's stock exchange seconds after it opened on Monday when the blue chip index dropped 5.92 per cent following a mass cabinet resignation in the face of an economic crisis. The S&P index fell more than the 5 per cent needed to trigger a circuit breaker that halts trading for half an hour, the Colombo Stock Exchange said.

“The proposed transaction will enable HDFC Bank to build its housing loan portfolio and enhance its existing customer base. For HDFC Ltd. the biggest gain will be access to well-diversified low-cost funding and a huge customer base of HDFC Bank Ltd. Earlier NBFC’S used to enjoy regulatory arbitrage vis-à-vis banks, but the regulatory authorities have harmonized the same, thus making this merger necessary and creating a competitive advantage over its peers. The proposed merger will enable HDFC Bank to build its housing loan portfolio.”

“The housing loan market is at the cusp of a strong up-cycle along with tailwinds for the real estate sector, and it provides a steady secured asset class with very attractive risk-adjusted returns. This will increase the balance sheet size of the merged entity enabling it to underwrite large ticket size loans. Overall, this is a marriage made in heaven, creating increased scale, comprehensive product offering, balance sheet resiliency and the ability to drive synergies across revenue opportunities, operating efficiencies and underwriting efficiencies, hence benefiting stakeholders of both the companies,”

~Santosh Meena, Head of Research, Swastika Investmart Ltd.

– HDFC will acquire 41 per cent in HDFC Bank

– Merger to create third-largest company in India

– Merger ratio will be 42 shares of HDFC Bank to 25 shares of HDFC

– Merger to enable seamless delivery of home loans

– Merger completion expected by Q2 or Q3 of FY24

Shares of the recently listed Vedant Fashions, the owner of ethnic wear brand Manyavar, hit a record high of Rs 1,065, on rallying 7 per cent on the BSE in Monday’s intra-day trade. The stock surpassed its previous high of Rs 1,025 touched on March 31, 2022. The stock made its market debut on February 16, 2022. In the past one month, Vedant Fashions has outperformed the market by surging 25 per cent, as compared to a 11 per cent rise on the S&P BSE Sensex. The stock recovered 34 per cent from its 52-week low of Rs 793 hit on 24 February.

India manufacturing PMI for March stood at 54 vs 54.9 last month

Housing Development Finance Corporation (HDFC) said its board has approved merger of its wholly owned subsidiaries HDFC Investments Limited and HDFC Holdings Limited with HDFC Bank Limited. HDFC will acquire 41 percent stake in HDFC Bank through the transformational merger, according to an HDFC Bank filing with the stock exchanges. HDFC market capitalisation has crossed Rs 5 lakh crore.