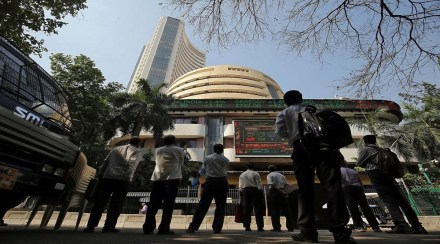

Share Market News Today | Sensex, Nifty, Share Prices HIGHLIGHTS: BSE Sensex and Nifty 50 snapped a 4-day losing streak and ended over 1% higher on Tuesday, recouping all the intraday losses. BSE Sensex ended 581 points or 1.10 per cent up at 53,424, while NSE Nifty 50 settled at 16,013, up 0.95 per cent or 150.30 points. Sun Pharma, Tata Consultancy Services (TCS), NTPC, Wipro, Tech Mahindra, UltraTech Cement, Dr.Reddy’s Laboratories, Infosys, ICICI Bank, Bharti Airtel were among top BSE Sensex gainers. On the flip side, Tata Steel, Power Grid Corporation of India, Titan Company, and Reliance Industries (RIL), were among top index draggers. India VIX was down 2.53 per cent to 28.59 levels. On sectoral front, barring Nifty Metal and Nifty Oil & Gas, all the indices ended in the positive territory. Nifty Bank index gained nearly one per cent, while Nifty IT jumped 2.7 per cent.

Share Market Today | Sensex, Nifty, BSE, NSE, Share Prices, Stock Market News Live Updates

BSE Sensex ended 581 points or 1.10 per cent up at 53,424, while NSE Nifty 50 settled at 16,013, up 0.95 per cent or 150.30 points

Nifty 50 has reclaimed 16000 mark as domestic headline indices soar with minutes left before the closing bell on Tuesday.

Coal India Ltd., the world’s largest supplier of the fuel, will add production of a key ingredient used in explosives for mining as it aims to tackle surging costs. The company plans to produce around 700,000 tons a year of ammonium nitrate, about half the amount it consumes, amid efforts to protect profit margins, according to people familiar with the details, who asked not to be identified as they aren’t authorized to speak publicly.

~ Bloomberg

India VIX, the fear gauge of domestic markets, was down 2% on Tuesday afternoon while benchmark indices soared. India VIX was still above 28 levels.

“As expected markets showing signs of short term reversal from highly oversold territory,” said Rahul Sharma, Director & Head – Research, JM Financial.

Among the NSE 500 companies, 37% of companies have declined by more than 20% from their 52-week highs. Among the Nifty companies, IndusInd Bank, Tata Steel, Divi’s Lab, Hero, Shree, Dr Reddy’s, Wipro, and BPCL are down by more than 20% from their 52-week highs. Motilal Oswal Financial Services

The London Metal Exchange halted trading in its nickel market after an unprecedented price spike left brokers struggling to pay margin calls against deeply unprofitable short positions. Nickel prices surged by as much as 250% over the past two days to hit record highs above $100,000 a ton, in the largest price move ever seen on the LME. The frenzied move came as investors and industrial users who had sold the metal scrambled to buy the contracts back, while brokers rushed to collect margin payments to cover their deeply unprofitable positions. Bloomberg

High crude price has led to a sharp jump in OMCs’ working capital needs; further, they are making gross margin of negative ~INR 21/ltr in diesel and petrol (vs. historical gross marketing margin of +INR3.5/ltr). Hence, OMCs need to hike diesel/petrol prices by INR 24-25/ltr to revert to normalised margins. However, there is scope for a cut in excise duty as it is still higher by INR 6-8/ltr vs. pre-Covid levels. JM Financial Services

BSE Sensex and Nifty 50 were trading nearly one per cent down on Tuesday, amid rising crude oil prices and Russia-Ukraine crisis. The 30-share index Sensex was ruling in red green on the back of selling in index heavyweights such as Reliance Industries Ltd (RIL), HDFC, HDFC Bank, Axis Bank, among others. NSE’s Nifty 50 index was down 0.7 per cent. So far in the day, only Power Grid Corporation of India stocks hit a fresh 52-week high. Power Grid Corporation of India stock touched a high of Rs 223.35 apiece, surpassing its previous high of Rs 220.85 per share. Read full story

Indian share market benchmarks BSE Sensex and NSE Nifty 50 have tumbled over 15% per cent from record high levels on the back of Russia-Ukraine war, and other global developments. Sandip Sabharwal, investment advisor, in an interview with Surbhi Jain of FinancialExpress.com, advises investors to exit stocks bought on tips and unsustainable expectations, and evaluate fresh opportunities to buy. Sabharwal also said that the recent sell-off can be used as an opportunity to buy new stocks, but in a staggered manner. Amid chip shortage and rising raw material cost, Sabharwal said that auto stocks can be bought on deep corrections. Read full interview

Small finance banks are now experiencing the benefits of having a banking license, allowing them to accept deposits. This has led to stable liabilities and lower cost of funds for these small finance banks (SFB), according to HSBC, opening up a Rs 7 lakh crore market opportunity. “SFBs face a Rs 7 lakh crore lending opportunity through expansion in products and penetration, as their funding costs decline,” analysts said in a report. The brokerage firm has maintained a buy rating on Equitas Holdings and Ujjivan Financial Services, with target prices that see strong upside potential.

Read full story

NYMEX crude trades mixed near $120/bbl after a 3.2% gain yesterday when it tested 2008 highs. Crude came off the highs amid lack of consensus between US and Europe over banning Russian energy exports. Restart of Libyan oil supply also weighed on price. However, supporting price are concerns about Russian supply, delay in Iran’s nuclear deal and OPEC’s stance to continue with gradual production hikes. Crude may remain volatile as market players assess Russia-Ukraine situation however tightness concerns may keep prices supported. Ravindra Rao, CMT, EPAT, VP- Head Commodity Research at Kotak Securities

COMEX gold trades marginally lower near $1991/oz after a 1.5% gain yesterday when it tested Aug.2020 highs. Gold is off the highs as market reaction to Russia-Ukraine tensions subsided amid lack of any immediate action on Russian energy exports and continuing talks between Russia and Ukraine. However, supporting price is inflation concerns with commodity prices at elevated levels on supply risks. ETF inflows also show buying interest in the metal. Gold may remain volatile as Russia-Ukraine tensions remain in focus however with no signs of resolution yet, risk sentiment may remain weak and this may keep prices supported. Ravindra Rao, CMT, EPAT, VP- Head Commodity Research at Kotak Securities

Technically, on the domestic front, USD/INR March has breached major resistance of 76.00-76.02 on 3 March and we saw continuation of the bullish momentum in the following day. In the upcoming session, we may witness prices getting challenged in 76.58-76.60 zone which is next immediate resistance zone. While on the downside, 76.18-76.15 levels may act as a relevant support area. We may also witness 15-SMA acting as a dynamic support on 15-Minute chart. Kshitij Purohit, Lead International & Commodities at CapitalVia Global Research

London nickel prices jumped more than 10% on Tuesday, adding nearly 87% of their value in the past two days, as increasing sanctions against Russia fuelled supply fears amid declining inventories of the stainless steel-making raw material. Three-month nickel on the London Metal Exchange climbed 10.3% to $53,005 a tonne by 0305 GMT. Prices shot up by a record 90.2% to an all-time high of $55,000 in intraday trade on Monday, before closing more than 66.3% higher. Read full story

Finance Minister Nirmala Sitharaman said Tuesday she sees possibility of revenue generation for the government through crypto assets, days after government proposed a tax of 30% on income from cryptocurrencies and other digital assets in Budget. “Many Indians have seen future in crypto, therefore I see a possibility of revenue in it,” Sitharaman said Tuesday at India Global Forum, when asked if she sees a future of crypto in the country. Read full story

The future of prosperity and financial prudence lies in the hands of women in India. Women now have more influence on society than ever before including politics, sports, law, and defence. I strongly believe women make great investors, particularly in the realm of finance and investment, because they are patient and goal-oriented. Their ability to manage funds and savings both at home and at work is commendable. There is a growing trend of women using investment tools and that could be a huge opportunity for the financial institutions. With specific educational resources to help women investors make the best decisions, women are increasingly defying gender norms and achieving their financial objectives on their own. Kavitha Subramanian, Co-Founder, Upstox

Sensex and Nifty were struggling to shrug off the bearish sentiment on Dalal Street. Sensex was down more than 200 points while the NSE Nifty 50 was just below 15,800.

Gold and Silver prices retreated yesterday, a hope of ease over the Russia and Ukraine war. However, global uncertainty is still there due to which prices of some industrial commodities have exploded. And it will support the precious metals. Gold has support at 52500 and resistance at 54050. Nirpendra Yadav, Senior Commodity Research Analyst, Swastika Investmart

Globally, the sentiments continue to be fragile as equities, bonds, currencies bear the losses. Investors are watching US senate vote on the legislation seeking to ban the imports of Russian energy. It is expected that the move will create huge supply demand mismatch in the oil markets and will further push oil prices higher. On the other side, the third round of talks held between Russia and Ukraine-held in Belarus has failed to remove any deadlock between the two showing that the tensions will continue for some time more. Amit Pabari, Managing Director, CR Forex Advisors

“15900-16200 is a resistance patch for the index. Until then the trend remains bearish and any rally up or knee jerk reaction can be used to short the Nifty for lower targets. If we are unable to sustain above 16200, the market can fall to 15300,” said

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

The Indian rupee depreciated 1.05% to hit its lowest level against the US dollar on Monday amid soaring oil prices and continued outflows of foreign portfolio money on last trading session. The local unit is expected to depreciate further on Tuesday due to stronger dollar and higher crude oil prices. Further, pessimistic sentiments in the global markets may hurt the rupee. Additionally, consistent FII withdrawal from domestic markets will continue to put pressure on the rupee. US$INR (March) is expected to rise further towards 77.50 for the day, according to ICICI Direct. Read full story

The heightened volatility in the market continues. Nasdaq is now 20 % down from the peak indicating that it has entered bear market territory. Nifty is down 15% from the peak. All commodities have surged indicating imminent higher inflation. Even though the market is now oversold, sentiments are negative. The positive development from the market perspective is the exit poll projection of BJP doing well in UP. Declining bond yields in the US and the possibility of lower-than-feared rate hikes by the Fed are reliefs from the market perspective. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

Maruti Suzuki, HDFC Bank, Asian Paints, Reliance Industries Ltd (RIL), ICICI Bank, HDFC top index laggards.

Power Grid Corporation of India, NTPC, Tech Mahindra, ITC, Bajaj Finance, Sun Pharma, Bharti Airtel, Tata Consultancy Services (TCS) were among top Sensex gainers

BSE Sensex fell 183 points to trade at 52,660, while NSE Nifty 50 was down 65 points to rule at 15,797 on Tuesday

BSE Sensex fell 300 points to trade at 52,533, while NSE Nifty 50 was down 176 points to rule at 15,687 in pre-opening session

Petrol and diesel prices were left untouched on March 8 by oil marketing companies (OMC) even as crude oil prices soared on the back of supply-demand imbalance. Petrol in the National Capital of Delhi currently retails at Rs 95.41 per litre while diesel in the city is priced at Rs 86.67 per litre. In Mumbai, a litre of petrol and diesel cost Rs 109.98 and Rs 91.09, respectively. Fuel prices have been stable since the central government cut excise duty to bring down retail rates from record highs in November last year. Read full story

Indian equity market on Monday continued its downwards journey in line with global peers amid escalating Russia-Ukraine conflict. Both benchmark indices Sensex and Nifty 50 are now down around 15% from all-time highs. The decline in the index has brought trading levels last seen in June 21. Read full story

Sensex and Nifty extended their losses on Monday as the benchmark indices tanked nearly 2.5% each. S&P BSE Sensex is now placed at 52,842, down nearly 10,000 points from its all-time high while the NSE Nifty 50 is placed at 15,863. Bank Nifty is currently at 32,871. Ahead of Tuesday’s trade, SGX Nifty was trading in the red, suggesting another gap-down opening for Dalal Street. Global cues were also weak as indices moved south owing to rising crude oil prices that fanned inflation concerns and raised questions about the economic expansion. Read full story