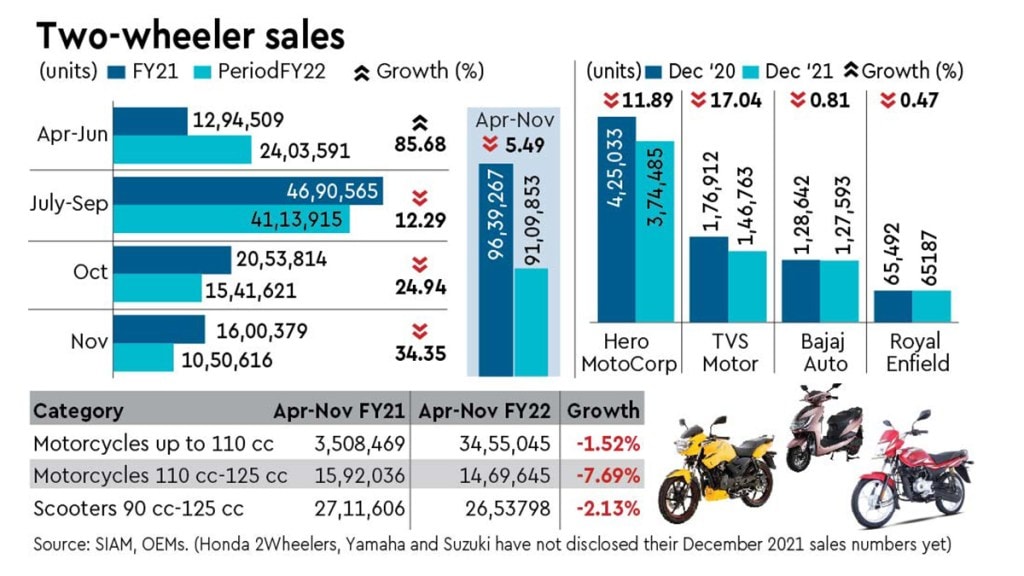

Increase in cost of ownership due to multiple price hikes by OEMs, and high fuel price saw domestic two-wheeler sales decline 5.49 per cent y-o-y during April-November period.

While sales had increased 85.68 per cent y-o-y during the April-June quarter due to a low base, it declined 12.29 per cent y-o-y during the July-September period. During October and November, sales once again fell 24.94 per cent y-o-y and 34.35 per cent y-o-y respectively.

In December, Hero MotoCorp posted a decline of 11.89 per cent y-o-y, TVS Motor Company 17.04 per cent, Bajaj Auto 0.81 per cent and Royal Enfield 0.47 per cent.

According to rating agency Icra, the domestic demand for two-wheelers is likely to contract for the full fiscal with a decadal low festive season offtake.

“On the demand side, there has been a decline in low-income households (economic impact of Covid, especially second wave). This is visible in segment-wise sales where entry-level segments are most affected, and also OEMs with a heavy focus on entry-level segments are most affected,” Atul Jairaj, director, Deloitte India, told FE.

During the first eight months of FY22, the domestic sales of motorcycles with an engine capacity of up to 110cc fell 1.52per cent y-o-y to 34,55,045 units, whereas motorcycle sales in the 110cc to 125cc category dipped 7.69 per cent to 14,69,645 units. In the same period, scooter sales in the 90cc to 125cc segment declined 2.13 per cent to 26,53,798 units.

“For the last couple of months, sales of two-wheelers under 125cc, which contributes towards a major share of entire two-wheeler portfolio in the Indian market, are witnessing weak demand and deferments due to fuel price hike and lower propensity to consume by the semi-urban and rural economy. Notably, the rural sector has seen the slowest recovery after the second Covid-19 wave and has not reached the year-ago level,” said Saket Mehra, partner and auto sector leader, Grant Thornton Bharat.

IHS Markit’s powertrain forecasts associate director Suraj Ghosh said, “Majority two-wheelers fit in the entry-level segment, targeted at the rural market and urban commuter segment. Both these key segments are facing the brunt of Covid-induced economic duress. Also, there were several price hikes as manufacturers are under cost pressure due to rising input costs. To add to the woes, the rising fuel prices have also adversely affected the demand.”

In 2021, OEMs like TVS Motor Company, Bajaj Auto and Royal Enfield had increased the prices of their two-wheelers on multiple occasions. Two-wheeler market leader Hero MotoCorp had hiked the prices of its motorcycles and scooters four times last year — January (up to Rs 1,500), April (up to Rs 2,500) July (up to Rs 3,000) and September (up to Rs 3,000).

Author: Varun Singh