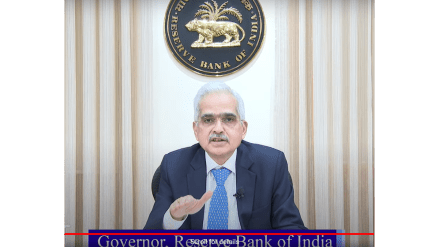

RBI Monetary Policy Announcement: The Reserve Bank of India’s (RBI) has kept the Benchmark interest rate unchanged at 6.50%. The RBI has stayed on hold for the past 18 months and the meeting that just ended is the 50th meeting of the RBI Monetary Policy Committee since its inception in September 2016. The detailed assessment of the macroeconomic conditions helped the RBI to decide on the current rate stance. According to RBI Governor also said the MPC remains focussed on withdrawal of accommodation to ensure inflation ultimately aligns with the RBI target.

The next RBI MPC meeting is scheduled on October 7-9. The MPC has kept the repo rate unchanged in the previous eight policy reviews. With today’s decision, the RBI has kept rates unchanged for the ninth consecutive time.

Dharmakirti Joshi, Chief Economist, CRISIL, said, “Monetary policy expectations from the most influential central bank in the world, the US Federal Reserve, are becoming less restrictive for the emerging markets. The European Central Bank (ECB) and Bank of England (BOE) have already initiated rate cuts. The Fed is now expected to begin cutting rates next month due to cooling labour markets.

On the domestic front, with a lower fiscal impulse and investment focused spending, the budget was clearly non-inflationary. But that is not enough for the RBI to initiate rate cuts yet. Other domestic factors, particularly inflation, still dictate a cautious wait and watch approach.

Food inflation is a hurdle and without a durable decline in it, headline inflation cannot be tamed to 4% on a sustained basis. A pick-up in food inflation in June dragged consumer inflation to 5.1%. To boot, the growth momentum remains strong. Inflation should decline in July, but the RBI will overlook it because that will be purely a high-base effect.

We expect RBI to begin cutting rates in October at the earliest and have penciled in two rate cuts this fiscal. By then, there will be clarity on food inflation as the monsoon would have played out. Good progress on rains and sowing so far offers hope.”

Suman Chowdhury, Chief- Economist and Head- Research, Acuité Ratings & Research Limited, said, “One of the important takeaways from the MPC statement was RBI’s acknowledgement that there is a potential structural challenge in bank deposit mobilization. It has advised banks to focus on branch deposit mobilization in a bigger way to mitigate the volatility in larger ticket short term deposits. Further, it has instructed banks and NBFCs to monitor the end use of home equity (LAP) and gold loans amidst the potential risk of such leveraged funds getting deployed in the stock markets.

There are some other measures announced by the RBI which will help borrowers and banks. The public depository on digital lending apps deployed by regulated entities will help to have a control on unauthorized apps. CICs would now have more updated credit information with data frequency from lenders increased to a fortnightly level. Lastly, steps have been taken to improve payments systems with faster cheque clearing and higher payment amounts through UPI.”

Suman Chowdhury, Chief- Economist and Head- Research, Acuité Ratings & Research Limited, said, “As expected, the Aug meeting of MPC has been a complete status quo policy with no changes whatsoever in rates or stance. Clearly, the policy stance remains strongly disinflationary in the background of economic resilience and healthy growth momentum in the current year.

While RBI has slightly downgraded the growth print for the first quarter to 7.2%, there has been no alteration to the earlier growth estimates. It expects a better monsoon to support the ongoing recovery in rural consumption and the momentum in the services sector to support urban demand. Further, it also believes that private investments would see a material pickup in the current year.

As regards inflation, RBI MPC continued to focus on the headline CPI inflation which has a significant element of food inflation. While RBI highlighted the disinflationary developments in food inflation such as improved monsoon, higher cereal stocks and generally benign global food prices, it also reiterated that food inflation shocks are persistent and merits caution. . It has increased the forecast for Q2 to 4.4% albeit the overall forecast has been unchanged at 4.5% for FY25. RBI governor also strongly defended the MPC target of headline CPI inflation, maintaining food prices influence household inflation expectations and can spillover to core inflation rapidly in a scenario of strong aggregate demand.

On the external front, RBI highlighted the improved CAD and increasing forex reserves (USD 657 bn early Aug) while also noting that the latest global market volatility has had an impact on the INR.”

Amit Bhagat, CEO and Managing Director, ASK Property Fund, said, “Residential real estate sales are likely to witness a strong growth momentum despite a status quo on the repo rates on the back of robust consumer confidence as also evident in strong pre sales growth recorded by most listed players across top cities. Ongoing and upcoming infrastructure and creation of new job corridors have led large well-established regional and national players to launch projects across micro markets of cities and cater to different income segments of the prospective home buyers. Factors like resilient domestic economic growth and strong launch pipeline for most players are likely to drive demand for new homes in the coming quarters as well.”

Sunil Damnia, Chief Investment Officer, MojoPMS, said, “Statements from central banks have gained heightened importance following Japan’s interest rate hike, with significant attention on the Federal Reserve’s potential acceleration of rate cuts in the United States. Considering the global context, along with the higher base effect and favourable monsoon conditions, it would have been prudent for the RBI to cut interest rates in the latest monetary policy. However, the RBI opted to maintain the status quo to safeguard the rupee, which has recently faced downward pressure. The RBI’s retention of GDP growth and inflation projections for FY2025 is reassuring.”

Pralay Mondal, MD & CEO, CSB Bank, said, “The Central Bank has been looking at data and deciding on policy objectively. The food inflation and the impact of base effect on inflation doesn’t warrant a looser monetary policy. The reduction of reporting periodicity to CIC and continuous clearance of cheques are welcome steps. We believe that RBI will continue to keep the system liquidity in surplus to ease pressure on bank deposits.”

Dr Aurodeep Nandi, India Economist, Executive Director at Nomura, said, “Whisper words of wisdom, let it be” – John Lennon’s famous song best summarises the RBI’s current monetary policy stand with both, rates and stance unchanged. The guidance remained predictably tilted in favour of focusing on inflation, with comfort on growth outlook, although we note a surprising downgrade to the Q1 FY25 GDP growth forecast in acknowledgement of softer-than-expected data. Our view remains that the RBI is on the precipice of a policy pivot, and we continue to expect the RBI to begin easing in the next meeting in October, delivering a 25bp cut.”

Amit Somani, Senior Fund Manager-Fixed Income, Tata Asset Management, said, “RBI remains focused on bringing down headline inflation within target range on a sustainable basis. We expect the short-term rate curve will be driven by Banking System Liquidity as near-term policy rates are likely to remain in status quo mode. Current Short-term rates offer an attractive avenue to investors with a near-term investment horizon.”

KV Srinivasan, Executive Director and CEO, Profectus Capital Ltd, said, “As expected, the RBI has maintained policy rates at existing levels with no change in stance of withdrawal of accommodation. The RBI wants to ensure that inflation comes down to its permissible range before reducing policy rates. Nonetheless, the RBI has ensured sufficient liquidity. From an MSME perspective, it’s better to have a stable interest rate scenario, and the RBI’s long pause in cutting interest rates is appropriate in the given macro environment.”

Anirudh Garg, Partner and Fund Manager, Invasset, said, “The RBI‘s monetary policy was expected to remain stable, as reflected in today’s announcement. India cannot afford to raise rates significantly before the US Federal Reserve, as this would risk depreciating the Indian rupee. With inflation under control at around 4.5%, which is on the lower end of the RBI’s target band, India is in a relatively strong position compared to other global economies. However, leading the charge in rate cuts ahead of global peers, especially the Fed, could be premature and risky.”

He further addded, “Lower corporate profits this quarter have been a surprise, but we believe that bull markets often thrive on bad news. The recent correction, partly influenced by Japan’s potential rate hikes, has provided a solid foundation for market recovery. According to our technical analysis, we anticipate the markets to reach 26,200+ levels soon. This optimistic outlook is driven by the strong economic fundamentals and investor confidence in India’s stable monetary policy and growth prospects.”

Puneet Sharma, CEO and Fund Manager, Whitespace Alpha, said, “The RBI‘s decision to maintain interest rates is a calculated move that balances the need for economic stability with the ongoing challenge of inflation control. The focus on key inflation figures, especially food inflation, underscores the central bank’s commitment to price stability. This alignment with market expectations minimizes any negative impact on investor sentiment. Moreover, the introduction of measures to improve operational efficiencies for lenders demonstrates a proactive approach to strengthening the financial sector. However, the Governor’s hawkish tone suggests that a rate cut in the near future is less certain, reflecting a cautious stance in the face of inflationary risks. This decision reinforces the RBI’s strategy of cautious optimism, aiming for a stable and sustainable economic environment.”

Manish Chowdhury, Head of Research, StoxBox, said, “The RBI has decided to keep the repo rate unchanged in its August MPC meeting, reflecting India‘s robust growth despite uncertainties in weather, geopolitics, and AI-driven tech disruptions. While the economic outlook remains positive, the central bank refrained from revising the inflation forecast downwards due to elevated food prices. Confident in its inflation management efforts, the RBI aims to achieve its 4% target without disrupting liquidity. India’s economy is buoyed by resilient high-frequency and fiscal indicators, supported by an all-time high forex reserve, positioning the RBI well to handle unforeseen risks. However, the slow pace of inflation moderation necessitates caution.”

On the global front, the RBI governor added, “The global economic outlook remains resilient although with some moderation in pace. Inflation is retreating in major economies, but service price inflation persists. International prices of food, energy and base metals have eased since the last policy meeting. With varying growth-inflation prospects, central banks are diverging in their policy paths. This is creating volatility in financial markets. Amidst recent global sell-offs in equities, the dollar index has weakened, sovereign bond yields have eased sharply, and gold prices have soared to record highs.”

Meanwhile, domestically, strong urban and rural consumption helped to maintain economic stability, while the global outlook shows steady but uneven expansion. He reiterated the focus on sustainably reducing inflation towards the 4% target before considering a policy shift. Given the current momentum in high-frequency indicators, there is optimism for upward revisions to GDP forecasts going forward. With more clarity on FY26 inflation and GDP growth trajectory going ahead, we expect the RBI to initiate a dovish stance from Q3FY25 and a probable rate cut in Q4FY25.

“As a fund house, we expected the status quo on the interest rates and the withdrawal of the accommodative stance. Inflation continues to be the number one priority followed by credit growth and deposit mobilization by the banks. RBI continued to keep the inflation forecast for FY 25 at 4.5%. Global factors such as rising interest rates in Japan, geo-political instability in the Middle East, rate cut by the Bank of England and timing of rate cut by the US Fed will influence the future monetary policy stance of RBI,” said Deepak Ramaraju, Senior Fund Manager at Shriram AMC.

Sonal Verma, Managing Director, and Chief Economist (India and Asia ex-Japan) at Nomura, said, “Even though the stance is unchanged, we think it is a neutral hold. The downgrade to Q1 GDP (from 7.3% to 7.1%) due to weak high frequency data was a surprise to us, since the RBI has so far been raising its growth forecasts, so it is acknowledging softer numbers incrementally. On inflation, the near-term upward revision has been offset by downward revision to Q4, implying the food price shock is seen as transitory. Our estimates show that the RBI’s upward revision to Q2 CPI (from 3.8% to 4.4%) may not materialise, since food prices are already reversing in August, so inflation may surprise lower relative to the RBI’s near-term forecast.”

“We expect the RBI to begin its easing cycle from October with a 25bp cut, as both inflation and growth surprise on the downside. Past evidence suggests the RBI does not offer any forward guidance ahead of its monetary policy pivots. We expect 75bp worth of cumulative easing in this cycle to a terminal repo rate of 5.75% by March 2025,” she added.

Vimal Nadar, Senior Director & Head, Research, Colliers India, said, “In the first MPC meet after the Budget, the RBI has projected a GDP growth rate of 7.2% for FY 2025 led by robust high frequency economic indicators across key sectors. Interestingly, stability in interest rates coupled with the recent announcement to rationalize stamp duty charges along with concessions for women homebuyers bodes well for the real estate sector especially residential segment. Strong visibility in financing charges should help homebuyers and developers alike in the upcoming festive season. Moreover, partial withdrawal of the applicability of the revised LTCG tax arising out of sale of land & buildings retrospectively provides elbow room to affect housing sales with minimal tax outgo. This is likely to buoy investors’ & homeowners’ sentiment and thus the real estate sector at large throughout 2024.”

Manju Yagnik, Vice Chairperson, Nahar Group and Senior VP, NAREDCO, Maharashtra, said, “The RBI‘s decision to maintain a status quo on the repo rate for the ninth consecutive policy review is a testament to the stability and caution in India‘s economic environment. This consistent approach is beneficial for homebuyers and house loan borrowers, as it keeps EMIs modest and borrowing costs predictable. The real estate sector will benefit from this stability, leading to increased sales and investments, and ultimately promoting economic growth. The RBI’s commitment to balancing growth and inflation is commendable, and I believe this approach will boost market sentiment and stimulate long-term investment in the housing market. Additionally, the recent budget’s focus on affordable housing, sustainable living, and transparent rental housing markets aligns with the RBI’s stance, showcasing a cohesive approach to driving economic growth and improving the quality of life for urban residents.”

Shaktikanta Das concluded, “We recognise the challenges along the way, but we have to be patient to finish the job at hand. In the current context, the following words of Mahatma Gandhi are highly relevant: “The slightest error of judgment, a hasty action or a hasty word may put back the hands of the clock of progress. Policies have, therefore, to be cautiously evolved…”

“Under the current monetary policy setting, inflation and growth are evolving in a balanced manner and overall macroeconomic conditions are stable. Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability; but we have more distance to cover. The progress towards our goal of price stability has been uneven due to large and persistent supply side shocks, especially in food items. We, therefore, need to remain vigilant to ensure that inflation moves sustainably towards the target, while supporting growth. This approach would be net positive for sustained high growth,” said RBI Governor Shaktikanta Das while concluding his speech.

At present, cheque clearing through Cheque Truncation System (CTS) operates in a batch processing mode and has a clearing cycle of up to two working days. RBi Governor Shaktikanta Das said, “It is proposed to reduce the clearing cycle by introducing continuous clearing with ‘on-realisation-settlement’ in CTS. This means that cheques will be cleared within a few hours on the day of presentation. This will speed up cheque payments and benefit both the payer and the payee.”

Shaktikanta Das said, “It is proposed to introduce a facility of “Delegated Payments” in UPI. This would enable an individual (primary user) to allow another individual (secondary user) to make UPI transactions up to a limit from the primary user’s bank account without the need for the secondary user to have a separate bank account linked to UPI. This will further deepen the reach and usage of digital payments.”

Foreign portfolio investors turned net buyers in the domestic market from June 2024 with net inflows of US$ 9.7 billion during JuneAugust (till August 6) after witnessing outflows of US$ 4.2 billion in April and May. Foreign direct investment (FDI) flows picked up in 2024-25 as gross FDI rose by more than 20 per cent during April-May 2024, while net FDI flows doubled during this period compared to the corresponding period of the previous year.

“External commercial borrowings moderated during April-June 2024-25, while non-resident deposits recorded higher net inflows during April-May compared to the previous year.51 India’s foreign exchange reserves reached a historical high of US$ 675 billion as of August 2, 2024.52 Overall, India’s external sector remains resilient as key indicators continue to improve.53 We remain confident of meeting our external financing requirements comfortably,” said Shaktikanta Das

RBI Governor Shaktikanta Das said, “The Indian financial system remains resilient and is gaining strength from broader macroeconomic stability. Its well-capitalised and unclogged balance sheet is reflective of higher risk absorption capacity. The NBFC sector and the Urban Cooperative Banks also continue to show improvements. “

“The MPC may look through high food inflation if it is transitory; but in an environment of persisting high food inflation, as we are experiencing now, the MPC cannot afford to do so. It has to remain vigilant to prevent spillovers or second round effects from persistent food inflation and preserve the gains made so far in monetary policy credibility,” Shaktikanta Das said.

Domestic economic activity continues to be resilient. RBI Governor Shaktikanta Das said, “On the supply side, steady progress in south-west monsoon, higher cumulative kharif sowing, and improving reservoir levels augur well for the kharif output. The likelihood of La Niña conditions developing during the second half of the monsoon season is likely to have a bearing on agricultural production in 2024-25.”

Manufacturing activity, he said, continues to gain ground on the back of improving domestic demand. “The index of industrial production (IIP) growth accelerated in May 2024. Purchasing managers’ index (PMI) for manufacturing at 58.1 in July remained elevated. Services sector maintained buoyancy as evidenced by the available high frequency indicators. PMI services stood strong at 60.3 in July 2024, and is above 60 for seven consecutive months, indicating robust expansion.” On the demand side, household consumption is supported by a turnaround in rural demand and steady discretionary spending in urban areas, he added.

Shaktikanta Das said that the global economic outlook exhibits steady though uneven expansion. “Manufacturing is indicating a slowdown, while services activity is holding up. Notwithstanding sticky services prices, inflation is receding grudgingly across major economies. With varying outlook for growth and inflation across countries, monetary policy is showing signs of divergence across jurisdictions. Several central banks are cautiously moving towards policy pivots through forward guidance and rate cuts; at the same time, there has been tightening by a few central banks.”

Global financial markets, he added, are exhibiting volatility. “Bond yields and the dollar index have softened since the last meeting. While the near-term outlook looks positive, there are significant challenges to the medium-term global growth outlook. Demographic shifts, climate change, geopolitical tensions and fragmentations, rising public debt and new technologies, such as artificial intelligence, pose new sets of challenges,” he said.

India’s financial sector remains stable and healthy, said RBI Governor but highlighted 4 key issues-

1. Alternative Investment avenues are becoming more attractive to retail customers and banks are facing challenges on the funding front with deposits trailing loan growth. Banks, as a result, are taking recourse in short-term non-retail deposits and other instruments to meet incremental credit demand. This may expose the banking sector to structural liquidity issues. Banks need to focus on mobilisation of household financial savings.

2. Excess leverage through retail loans for consumption purpose need careful monitoring: Sectors in which pre-emptive regulatory measures were announced by RBI in last November have shown moderation in credit growth. Certain segments of personal loans continue to clock high growth. Need to constantly reemphasise the need for monitoring.

3. Adhering to regulatory norms and monitoring of end use of Housing loans. Housing loans have been growing at a brisk pace. Banks and NBFCs have also been offering top up loans. Regulatory prescriptions with regards to loan to value, risk weights and end use of funds are not being strictly adhered to by certain entitites. Such practices may lead to loan funds being deployed to speculative activity or unproductive sectors. Banks and NBFCs are therefore advised to review such practices and take necessary remedial action.

4. Fast growing dependence on Big Tech and third party technology solution providers. It is necessary that banks and financial institutions build appropriate risk management frameworks in their IT, cyber security and third party outsourcing arrangements to maintain operating resilience.

Dr VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said, “The status quo in policy rates and stance were on expected lines. The Governor emphasised the need for vigilance on the inflation front saying “price stability is necessary for sustained growth. There is nothing in the policy that will influence the market much. The market will be focused on the US jobs data today and the market’s response to it and the recession fears in the US.”

Dharmendra Raichura, VP & Head of Finance, Ashar Group, said, “The Reserve Bank of India‘s (RBI) decision to maintain the repo rate at 6.5% for the ninth consecutive time demonstrates its dedication to achieving the 4% Consumer Price Index (CPI) target. Despite a slight increase in headline inflation to 5.1% in June 2024, the central bank’s commitment to economic stability is evident. With GDP growth projected at 7% in FY25 and inflation at 4.5%, the stable interest rate environment fosters long-term investments in housing. As a real estate developer, we appreciate the significance of a steady repo rate, which influences borrowing costs and impacts the property market. The consistent repo rate provides a favorable environment for sustainable development and growth in the real estate sector.”

India‘s forex reserves reach record high of $675 billion as of Aug 2.

Shaktikanta Das announced that the UPI tax payment limit increased from Rs 1 lakh to Rs 5 lakh per transaction.

“Currently, the transaction limit for UPI is Rs 1 lakh except for certain category of payments which have higher transaction limits. It has now been decided to enhance the limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction. This will further ease tax payments by consumers through UPI,” said the RBI Governor in his speech.