Indian auto parts makers have been hit hard by the slackening of demand in Europe, with many shutting down factories in the EU and projecting a grim and uncertain outlook.

New car registrations in Europe fell 2% year-on-year during the March quarter, while carmakers and their component-making partners resorted to plant shutdowns and job retrenchments.

While local demand in Europe has been weak, exports to the US are also under a cloud following the tariff action initiated by President Donald Trump.

Europe (including the UK) is one of the biggest markets for Indian auto parts makers, housing several factories catering to popular brands such as Volkswagen, Stellantis, Daimler, Renault, Ford and General Motors.

Exports of components from India to Europe are around 32.5% of the total parts exports in FY24. Motherson, Bharat Forge, Endurance and Sona Comstar have higher exposure to the European Union, including local manufacturing operations.

On April 25, a subsidiary of Apollo Tyres based in the Netherlands submitted a request for advice to a representative body to discontinue tyre production at its Enschede plant. The tyremaker said the decision to shut down the factory was driven by the continued increase in costs due to macro-economic disruptions, steep increases in energy and labour costs, and a decline in demand for Spacemaster and Agri tyres. Together with pricing pressure from low-cost competitors, operations have been rendered uncompetitive. The high-cost situation is expected to continue, therefore, long-term profitable production at Enschede is not in any way feasible, Apollo Tyres added.

“The European automotive industry is facing challenges of rising costs, transition to electric vehicles and competition from China. Renowned European automakers announced plant closures that sent shock waves through the industry,” said SP Shukla, chairman, CIE Automotive India (formerly Mahindra CIE) in the annual report statement. About 32% of CIE Automotive’s sales come from Europe.

Outlining the risks for Samvardhana Motherson (SAMIL), Ambit Capital said, “There has been an over 10% decline in automotive volumes in the US and the EU due to tariffs. There has also been a substantial increase in market share of Chinese players in the EU market.” Around 38% of SAMIL’s sales come from Europe.

Last week, SAMIL announced the winding down of operations at the Judenbach plant in Germany, which it had acquired through its purchase of Dr Schneider Group in 2023. The firm said this was a planned closure and that it will not have any impact on its finances.

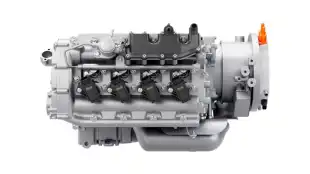

Analysts tracking Pune-based Bharat Forge said weakness in demand and risk of EVs gaining traction in Europe will be challenging for the company. The firm has a sizeable exposure to the heavy-duty trucks market of Europe which has seen a contraction in demand.

“The recovery of western Europe’s heavy commercial vehicle industry market in 2025 will be constrained by sluggish economic growth, declining order intake — as reported by numerous local OEMs — and political instability that creates significant uncertainty for businesses. On the upside, aging truck fleets will sustain truck demand as new regulations push companies to transition to clean vehicles,” a note by Ambit said.