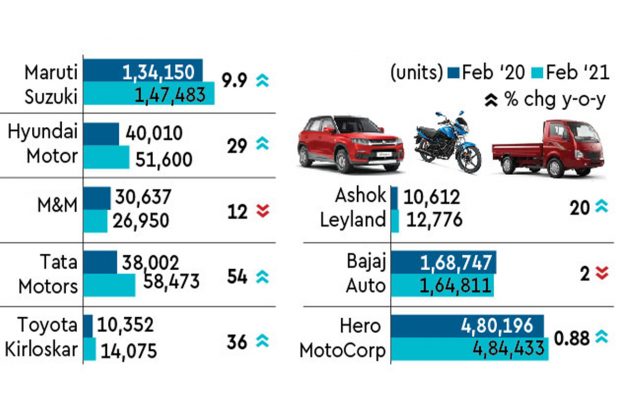

Wholesale despatches of passenger vehicles (PVs) were up 20-23% year-on-year in February, the seventh straight month of a rise as dealers stocked up to replenish depleted inventories.

A low base effect also helped boost despatches. While despatches of commercial vehicles (CVs) were also reasonably good, the trend for two-wheelers was mixed.

Dealer inventory for PVs is around 10-15 days compared with the normal 30-35 days, indicating retail sales are fairly brisk. The long waiting period for some vehicles is due to the shortage of some key components such as semi-conductors which has hit production.

Industry estimates suggest Maruti Suzuki has bookings for around two lakh vehicles while Hyundai Motor for one lakh vehicles. Customers need to wait for 4-6 weeks for a popular model from Maruti or Hyundai rather than the normal waiting period of 7-10 days.

Despatches of commercial vehicles were good with Tata Motors numbers up 21% y-o-y and Ashok Leyland posting strong growth of 20% y-o-y.

According to analysts, the MHCV segment has been improving on strong tipper and intermediate CV demand and a gradual recovery in replacement demand as well.

While Bajaj Auto reported tepid wholesale numbers in February, TVS Motors registered a good double-digit increase. Hero MotoCorp’s despatches were up near 1% y-o-y at 4.84 lakh units. The company’s passenger vehicle business had an even better run in February as the sales were the highest in nearly nine years, registering an increase of 119% y-o-y with 27,225 units sold.

India’s largest PV manufacturer Maruti Suzuki sold 1,47,483 units in February, up 10% on a y-o-y basis and in line with its traditional average monthly sales of 1.5 lakh units per month. On a month-on-month basis, the company registered a flat growth.

Hyundai Motor India recorded a y-o-y growth of 29% in domestic sales with 51,600 units sold in February, while on a m-o-m basis, the sales numbers remained flat.

Tarun Garg, director (sales, marketing & service), Hyundai Motor India, said, “Both domestic and export demand have recorded healthy double-digit growth in February 2021, reflecting an all-round improvement in buyer sentiment”.

Mahindra and Mahindra’s PV segment did well, clocking total sales of 15,391 units, a sharp increase of 41% y-o-y. However, the company’s CV sales dragged its overall sales numbers, declining 12% on a y-o-y basis to 26,950 units. Veejay Nakra, CEO (automotive division), M&M, said, “Demand continues to remain buoyant for our range of SUVs and pick-ups and we have a robust order pipeline.” However, Nakra raised concern over the supply shortage of semi-conductors and said it is likely to continue for another 3-4 months.

Vehicle sales for Toyota Kirloskar Motor (TKM) also remained strong in February, as it recorded an increase of 36% on a y-o-y basis to 14,075 units. The company improved its sales numbers against January as well.

Naveen Soni, senior vice-president, TKM said, “Wholesales have been very encouraging and we are witnessing a high influx of customer orders month on month, thereby both significantly contributing to the growth story”.

Sales of two-wheelers remained mixed in February, primarily due to weak demand for the entry-level segment in north India and lower marriage season demand. Also, executive and premium motorcycles are doing better than entry-level motorcycles, analysts said. Bajaj Auto witnessed a decline of 2% y-o-y in sales as it sold 1,64,811 units during the month. However, volume performance in south, east and west regions has been better compared with north. TVS Motor’s domestic two-wheeler sales grew by 15% y-o-y, registering 1,95,145 units in February 2021.