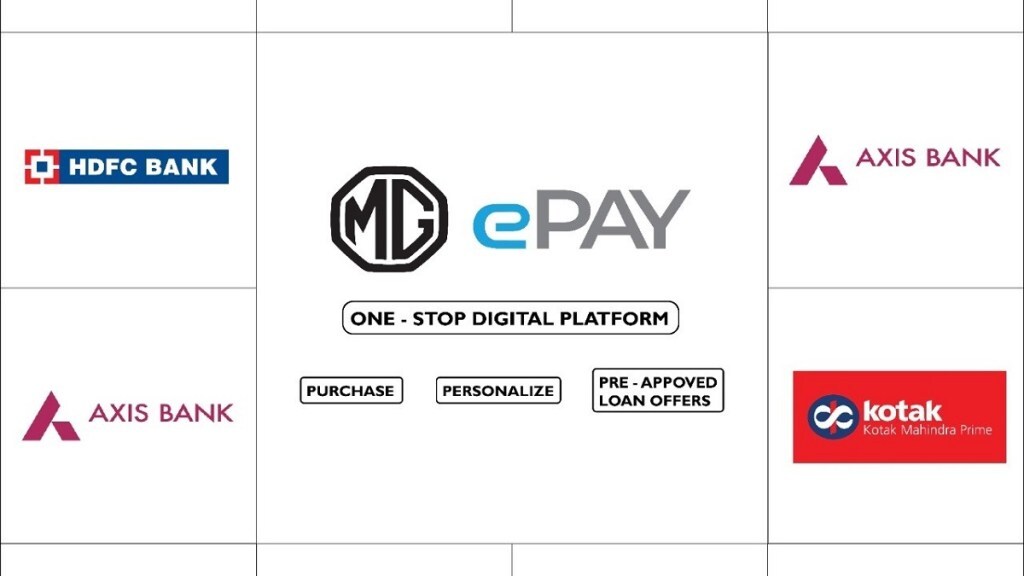

MG Motor India has today launched its End-to-End financing option for its automotive product line-up called MG e-Pay. The one-stop solution for car financing is designed to offer instant loan approvals to buyers. Also, the product will provide consumers with a transparent loan disbursement process with the flexibility to use it from their homes themselves. MG has tied up with four Indian banks, namely ICICI Bank, Kotak Mahindra Prime, Axis Bank, and HDFC Bank.

Speaking on the launch of MG ePay, Gaurav Gupta, Chief Commercial Officer – MG Motor India, said, “At MG, we are constantly innovating our digital platforms to stay connected with our customers and ensure the best-in-class experience. After effectively catering to over a million customers through the MG online buying platform, we intend to take a step further and simplify customer journey to avail suitable financing options for buying cars online”.

MG Motor India has managed to reinforce a completely digital car exploration and buying process earlier with the help of MG eXpert. The MG eXpert showcases the MG range to buyers digitally via the help of augmented reality. Moreover, they can have a look at their choice of cars with their preferred accessories as well. With the introduction of MG e-Pay, even the financing exercise has moved to the digital route.

As per MG, the MG e-Pay will make the complete car buying process finish in only 5 clicks and 7 steps. Via the MG e-Pay, buyers get the offer to select their desired pre-approved loans from a slew of financiers available on board. The loan can be customized in terms of tenure, principal amount, and rate of interest. The loan application can also be tracked in real-time, along with the status of the disbursement letter. Once the loan is disbursed, the vehicle will be delivered to the consumers at their doorsteps.

Also Read – New Mercedes-AMG GT Track Series unveiled: Unfiltered performance