Tata Motors has been keen on shedding an image it has unintentionally built for itself over the last two decades. A decline that started with the infamous Tata Nano. A car that created an almost unending buzz ahead of its launch, ‘the world cheapest car”, the sirens would bleat. “A car to replace all motorcycles,” many said but in that thought only was the Nano’s ultimate damnation. You see there’s a detailed report on the Nano’s Marketing Failure on the Harvard Business Review, a case study into why Tata Motors failed with their Nano. The report mentions stalled production lines, thanks to Mamata Banerjee and the Singur fiasco, the fact that Tata attempted to achieve scale at the time of initial production to achieve cost and finally the fact that they were marketing to the wrong customer. The report says, a more comprehensive study of the customer base would have revealed their target wasn’t to be a motorcycle upgrader but a family looking for a second car as a cheap and convenient go-for. The tombstone in it all was the fact that customers still couldn’t find concrete after sales solutions in the Tata brand name aside from the Nano having initial safety issues like catching fire. Tata says they have learnt their lesson, with Guenter Butschek taking the wheel for the Tata Motors early in 2016. The company started to make the slow painful climb out of the slippery slope that they had found themselves in.

In the last two years, positive reports from Customer Service adjudicators like JD Power have found Tata Motors’ After Sales surging forward to second only to the likes of Maruti and Hyundai, the two largest manufacturers in terms of volume sales in India. Exciting products like the Nexon that lost little from the concept showcased in 2014 to the time it was ultimately produced in 2017, just powered the company’s progress. In December 2017, Tata Motors declared a net profit of Rs 184 crores for the quarter ending 31st December. That helped the owner of British luxury car firm Jaguar Land Rover Plc post an 11-fold jump in its consolidated profit for the quarter, proving that Tata Motors was indeed on the uptake, and how!

It would seem like the stability couldn’t have come to a second sooner, as the entire automotive industry stands ahead of uncertain times ahead. As two powerful global lobbies collide, ushering in “the end of fossil dependence”; Tata motors has risen to the occasion. Tata seems to have embraced the paradigm shift to Electric with arms wide open, coming out of the corner swinging, quickly snatching an EESL contract for 10,000 Electric cars.

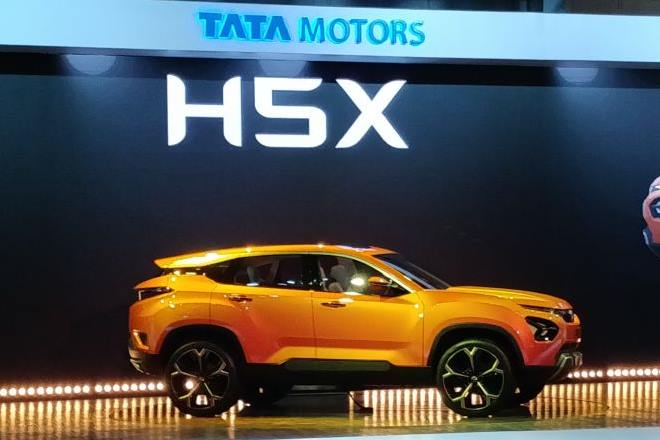

From the outset of 2018, Tata Motors looks to be trying to keep their momentum going, with concepts like the H5X and the 45X sedan breaking cover at the Indian Auto Expo 2018. The Land Rover platform based H5X is set to launch this year to take on the likes of the Jeep Compass and the Mahindra XUV500 and has the country waiting with bated breath. Not long after the Indian Auto Expo, Tata took the world stage in Geneva to showcase their prowess in EVs with a concept simply astonishing. Christened the E-Vision Concept, Tata said it would be their Halo machine with high-levels of technology and autonomy inbuilt! The problem is, even before the E-Vision has headed into production, questions, whether it may be a little bit of stretch for Tata’s development team, have been raised.

We are glad, that Tata hasn’t tried to alienate the product by changing it too much. As is the case with the odd-ball E20 hatch, which looks mildly relatable to what we have come to expect from an automobile. Instead, we feel more successful with a simple electrification program targeted at vehicles that they already produce. This will give them more time to set up their completely revamped line-up in time for their 2023 target. Negating problems that are born off high pre-launch expectations that constrict your freedom to update your product strategy mid-term, considering that flexibility is paramount in emerging market innovation and product strategy.

Tata Motors appear to be on the right track for now so as to put itself in an advantageous position for India’s shift to electric mobility. The company, however, needs to make sure it has the bandwidth to deliver on the expectations it is raising.