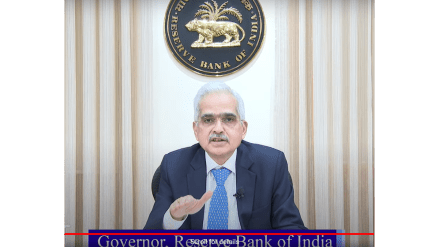

RBI Monetary Policy Announcement: The Reserve Bank of India’s (RBI) has kept the Benchmark interest rate unchanged at 6.50%. The RBI has stayed on hold for the past 18 months and the meeting that just ended is the 50th meeting of the RBI Monetary Policy Committee since its inception in September 2016. The detailed assessment of the macroeconomic conditions helped the RBI to decide on the current rate stance. According to RBI Governor also said the MPC remains focussed on withdrawal of accommodation to ensure inflation ultimately aligns with the RBI target.

The next RBI MPC meeting is scheduled on October 7-9. The MPC has kept the repo rate unchanged in the previous eight policy reviews. With today’s decision, the RBI has kept rates unchanged for the ninth consecutive time.

India’s current account deficit (CAD) moderated to 0.7 per cent of GDP in 2023- 24 from 2.0 per cent of GDP in 2022-23 due to a lower trade deficit and robust services and remittances receipts. “In Q1:2024-25, merchandise trade deficit widened as imports grew faster than exports. Buoyancy in services exports and strong remittance receipts are expected to keep CAD within sustainable level in Q1:2024-25. We expect CAD to remain eminently manageable during the current financial year,” said Shaktikanta Das

RBI Governor Shaktikanta Das said that the manufacturing activity continues to gain ground on the back of improving demand.” He added that the domestic economic activity continues to be resilient.

RBI Governor Shaktikanta Das said, “Banks are facing challenges on the funding front as alternative investment avenues become more attractive” while adding that this may expose the banking system to structural stability issues.

He also maintained that the banks are finding it challenging to raise deposits.

Private corporate investment is gaining steam on the back of expansion in bank credit, Shaktikanta Das said. Healthy balance sheets of banks and corporates, thrust on capex by government and visible signs of pickup in private investment will drive investment prospects, he said.

India’s financial sector remains stable and healthy says RBI Governor but highlights 4 key issues-

1. Alternative Investment avenues are becoming more attractive to retail customers and banks are facing challenges on funding front with deposits trailing loan growth. Banks, as a result are taking recourse in short-term non-retail deposits and other instruments to meet incremental credit demand. This may expose banking sector to structural liquidity issues. Banks need to focus on mobilisation of household financial savings.

2. Excess leverage through retail loans for consumption purpose need careful monitoring: Sectors in which pre-emptive regulatory measures were announced by RBI in last November have shown moderation in credit growth. Certain segments of personal loans continue to clock high growth. Need to constantly reemphasise need for monitoring.

3. Adhering to regulatory norms and monitoring of end use of Housing loans. Housing loans have been growing at a brisk pace. Banks and NBFCs have also been offering top up loans. Regulatory prescriptions with regards to loan to value, risk weights and end use of funds are not being strictly adhered to by certain entitites. Such practices may lead to loan fund be deployed to speculative activity or unproductive sectors. Banks and NBFCs are therefore advised to review such practices and take necessary remedial action.

4. Fast growing dependence on Big Tech and third party technology solution provider. It is necessary that banks and financial institution build appropriate risk management framework in their IT, cyber security and third party outsourcing arrangements to maintain operating resilience.

Shaktikanta Das emphasized the need to prioritize inflation and ensure price stability to support growth. He noted that while India‘s growth remains robust, inflation is on a declining trajectory, with core inflation reaching historic lows in May and June.

The RBI‘s inflation target is 4%, with a tolerance band of 2 percentage points.

RBI Governor Shaktikanta Das said that food inflation has a weight of 46 per cent in headline inflation and it cannot be ignored. “MPC cannot afford to look through persistently high food inflation as it may spill over,” he said.

He further added that core inflation moderated to historic lows in May and June even as high food prices are likely to have continued in June as well. He also stated that a degree of relief in food inflation is expected from the pickup in southwest monsoon.

FY25: 4.5%

Q2: 4.4% (revised from 3.8%)

Q3: 4.7% (revised from 4.6%)

Q4: 4.3% (revised from 4.5%)

Q1FY26: 4.4%

RBI Governor Shaktikanta Das announced that the central bank has kept FY25 GDP projection unchanged at 7.2 per cent, with ‘risks evenly balanced’. For Q1, it is projected at 7.2 per cent, for Q2 at 7.2 per cent, for Q3 at 7.3 per cent and for Q4 at 7.2 per cent.

“The MPC judged that it is important for monetary policy to stay the course while maintaining a close vigil on the inflation trajectory and the risks thereof. Resilient and steady growth in GDP enables monetary policy to focus unambiguously on inflation. It must continue to be disinflationary and resolute in its commitment to aligning inflation to the target of 4.0 per cent on a durable basis. Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The commitment of monetary policy to ensure price stability would strengthen the foundations for a sustained period of high growth. Hence, the MPC reiterated the need to continue with the disinflationary stance of withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth,” said RBI Governor Shaktikanta Das.

Shaktikanta Das said, “While fuel group remains in disinflation, expected moderation in headline inflation in Q2 of this FY on account of favourable base may reverse in the coming quarters. In the third quarter, India has a substantial advantage that may pull down the inflation but the base effect will wear out.”

MSF and SDF rates unchanged at 6.75 per cent and 6.25 per cent respectively, RBI Governor Shaktikanta Das announced.

RBI Governor Shaktikanta Das said that the MPC has decided by 4:2 majority to maintain ‘withdrawal of accommodation’ stance.

RBI MPC decided by a 4:2 majority to keep the repo rate unchanged at 6.50 per cent, for 9 consecutive policies, Shaktikanta Das said.

RBI Governor Shaktikanta Das has started his speech to announce the decision on repo rate.

Deepak Agrawal, CIO-Debt, Kotak Mahindra AMC, said, “The Reserve Bank of India (RBI) is expected to keep the repo rate unchanged at 6.50% in its policy announcement on August 8, 2024. Despite a recent rise in inflation to 5.08%, driven by higher food prices, core inflation remains stable at 3.10%. The fiscal deficit has improved slightly, commodities such as crude have corrected sharply and monsoon conditions are favourable, which should help stabilize food prices leading to lower inflation. Global economic conditions, especially weaker US data and rate cuts by other major central banks, suggest a more dovish stance globally. However, the RBI is likely to maintain status quo on rates but the probability for a shift in MPC stance to neutral has increased.”

Barclays, earlier, predicted CPI inflation slowing to 3.3% YoY in July driven lower entirely by base effects. Shreya Sodhani, Regional Economist, Barclays, said, “We believe the MPC will likely look through this sub-4% print as it focuses on inflation outlook in H2 FY24-25 (Oct 2024-March 2025) to assess whether inflation is moving durably towards the target. We expect the MPC to remain on hold, as it considers the progress of the monsoon, international commodity prices, the uptick in domestic input prices, and the repricing in US Fed expectations over the last week. We maintain our forecast of an RBI rate cut in December, but note the risk of a delay if inflation does not progress in line with the RBI’s expectations. The timing of a rate cut by the RBI will also be influenced in the event of a significant global economic downturn weighing on domestic growth.”

According to economists, the June retail inflation was pushed up by increase in prices of vegetables and fruits amid heatwave and also a weak start of the southwest monsoon during the month. However, with rainfall gaining momentum, the vegetable prices are expected to cool down over the next 2-3 months.

Further, they said that an inflation print of +5 per cent, albeit seasonal, will likely keep the Reserve Bank of India Monetary Policy Committee (MPC) more hawkish and any decision to cut rates will not come before December 2024.

India’s retail inflation rose to four-month high of 5.08% in June, pushed up by a further spurt in already-elevated prices of vegetables and fruits amid heat waves that struck many parts of the country during the month, and the firmness of cereal prices. The headline print was on the higher side of expectations, and bucked a declining trend seen since December 2023.

In May, the inflation at the retail level, measured by consumer price index (CPI), was 4.8%, and in June 2023, it came in at 4.87%.

The announcement by RBI MPC today follows closely on the heels of the presentation of the Union Budget by Finance Minister Nirmala Sitharaman. Before this the Lok Sabha elections were announced wherein BJP failed to get a clear majority and formed a coalition government.

In the last quarter of FY23, on February 8, the RBI had increased the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.50 per cent.

The MPC had met in April before that to assess the macroeconomic situation and decided not to hike the country’s repo rate. The RBI MPC, with a 5:1 majority, maintained the withdrawal of accommodation stance, RBI Governor Shaktikanta Das had said. The RBI had also stated the real GDP growth projection for FY24 was at 6.5 per cent. However, fears of sustained core inflation remain persistent on weather-related vagaries, OPEC+’s surprise announcement and rising commodity prices.

RBI Governor Shaktikanta Das, during its June 2023 meeting, had said that the MPC has decided to keep the key policy repo rate unchanged at 6.5 percent. “MPC also decided by a majority of five out of 6 members to remain focused on withdrawal of accommodation to ensure inflation aligns with the target while supporting growth,” RBI Governor Shaktikanta Das had said. He also said that the standing deposit facility rate remained at 6.25 per cent, and marginal standing facility rate and bank rate remained unchanged at 6.75 per cent.

The RBI‘s monetary policy announcement is expected in few minutes from now. The RBI has kept the interest rates unchanged at 6.5 per cent for last 18 months.

IDFC First Bank expects the US Fed rate cut in September. The bank explains that, “The impact of the restrictive Monetary Policy is being felt on interest rate sensitive sectors such as housing. As a result, core services inflation which had been sticky is showing signs of easing as housing inflation reduces. The moderation in wage growth is supporting easing of inflation pressures in core services inflation. By the September Policy, the Fed will have five months of inflation prints (Q2 plus July and August) to assess the durability of the disinflation process.”

According to IDFC First Bank, “The RBI is expected to lag the Fed in terms of timing and quantum of rate cuts, as the gap between India and US policy rates has narrowed to fresh historical lows.” According to them, strong growth conditions in India have given RBI the headroom to stay on on pause till there is further clarity on food inflation risks and the US Fed’s policy.

After its three days meeting in August, the RBI governor said that the MPC decided to keep the key policy repo rate unchanged at 6.5 per cent, maintaining status quo for the third time in a row. The MPC voted in 5:1 majority to maintain the ‘withdrawal of accommodation’ stance to ensure that inflation progressively aligns with the target, while supporting growth, Shaktikanta Das had said. “Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent,” he had added.

Before December, the MPC meeting was held on October 4-6 and the central bank had decided to keep the key policy repo rate unchanged at 6.5 percent, maintaining the status quo for the fourth time in a row. The MPC decided by a majority of 5 out of 6 members to remain focussed at withdrawal of accommodation to ensure inflation aligns to the target by supporting growth.

During its December meeting, the RBI MPC had announced its decision to keep the repo rate unchanged at 6.50 per cent. This was the fifth meeting wherein the MPC decided to maintain the status quo on the repo rate. “The Reserve Bank of India’s Monetary Policy Committee after a detailed assessment of the evolving macroeconomic developments, has decided unanimously to keep the repo rate unchanged at 6.5 per cent,” RBI Governor Shaktikanta Das had said. The RBI governor had said that FY24 real GDP growth was projected at 7 per cent. Real GDP growth for the next year was projected at 6.7 per cent in Q1, 6.5 in Q2 and 6.4 in Q3.

Before the April meeting, MPC meeting was held on February 6-8 and the central bank had decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent. The MPC had also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. “These decisions are in consonance with the objective of achieving the medium- term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth,” Das had announced after the end of the three days meeting.