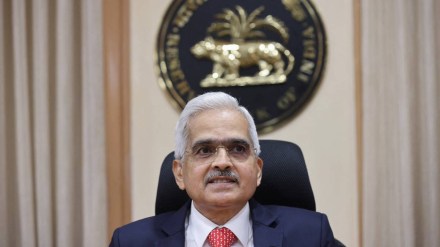

RBI MPC Meeting August 2023 Live Updates: The RBI will declare its monetary policy today. It is the third bi-monthly RBI Monetary Policy Committee meeting. The six-member Monetary Policy Committee meeting is headed by Governor Shaktikanta Das. Overall, there is an expectation that the Central Bank may maintain rates at the current level given the borrowing cost, which started rising in May last year, has stabilised.

The Reserve Bank of India may look to tighten domestic liquidity to rein in inflationary pressures but analysts believe RBI may refrain from permanent cash withdrawal. Cutting down the liquidity in the market is one way of Hawkish signalling by the RBI. Policy repo rate has been increased by 250 basis points since May 2022.

The RBI in its last statement had said that it will be monitoring inflation numbers closely. Das in his statement after the last MPC on June 8 had outlined that “there is no room for complacency.” He had also highlighted that, “Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain.”

Retail inflation based on Consumer Price Index (CPI) rose to a three-month high of 4.81 per cent in June, mainly on account of higher food prices. Though it is within RBI’s comfort level of below 6 per cent, it remains to be seen if there are any spillover impacts in inflation data for July, which will be released on August 14.

RBI Monetary Policy August 2023 Live Updates

The Monetary Policy Committee (MPC) had met in April before that to assess the macroeconomic situation and decided unanimously to keep the policy repo rate unchanged at 6.50 per cent.

The surge in vegetable prices is likely to push the CPI inflation above 6 per cent in July 2023. Moreover the average for this quarter would exceed the latest estimate for Q2 that the MPC had released in June 2023. As a result, we expect the MPC’s commentary to be fairly hawkish, amid a continued pause on the repo rate.

While the inflationary pressures are upwards owing to primarily vegetables and some other food items, given that the inflation print is going to be below 6%, the MPC can afford to continue with a pause. The yield differential between US and India is almost similar to what it was two months back and the reserves have become stronger crossing USD 600 billion. Thus, there is no immediate pressure or concern emerging from that front too. The demand continues to be weak at the lower value end of the spectrum and hence the Indian inflation continues to be a supply side driven one. Thus, there is no immediate trigger for a rate increase. The commentary will continue to be hawkish with emphasis on data dependent actions on the back of impacts seen from the rate increases by BoE, ECB and the US Fed.

The last MPC meeting was held on June 6-8 and the Central Bank had decided unanimously to keep the policy repo rate unchanged at 6.50 per cent. The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

We expect the Reserve Bank of India’s Monetary Policy Committee (RBI MPC) to keep the REPO rate unchanged as inflation rate in India remains within the upper threshold of tolerance. This will help the real estate sector maintain its current momentum. With the last few revisions, the repo rate has gone up by 250 BPS, and as a result of this, the base lending rate for home loans have increased by 160bps with the last three revisions being completely passed on to the home buyers. This has started to impact housing demand, especially in the affordable segment. The mid segment too has seen moderation with demand plateauing in the last few quarters. A further increase in the REPO rate could potentially dampen buyers’ sentiment and impact housing affordability.