By Srinath Sridharan

Indian financial regulators, who are already under pressure to keep up with the rapid pace of digital finance and frame adequate regulations, will be further challenged by the advent of quantum computing. The complexity and advanced capabilities of quantum technology will outstrip current regulatory frameworks and supervisory methods.

Quantum computing’s potential to revolutionise encryption, risk assessment, and algorithmic usage in financial processes will demand rapid adaptation and even stress-test assessment for fair transactions by the regulators. Its development can bring a significant threat to cybersecurity, especially due to its potential to render almost all encryption schemes obsolete.

For example, RSA encryption is widely used to secure online communications and financial transactions. Its security relies on the difficulty of factoring large prime numbers, a task that classical computers find extremely time-consuming and computationally intensive.

Quantum computers, however, can use Shor’s algorithm to factor these large numbers exponentially faster. This means, if a malicious actor had access to a quantum processor, it could decrypt sensitive financial information, potentially compromising everything from secure transactions to private communications.

Failing to prepare for the advent of quantum computing could pose severe risks to financial stability and expose the Indian financial system to significant security threats. Quantum computing’s ability to break current cryptographic standards could lead to widespread data breaches, financial fraud, and loss of trust in institutions. Unprepared financial markets might also face increased volatility and inefficiency as some entities gain disproportionate advantages through quantum-enhanced trading and risk analysis. A lack of preparedness could destabilise the entire financial ecosystem, with far-reaching consequences for the economy and national security.

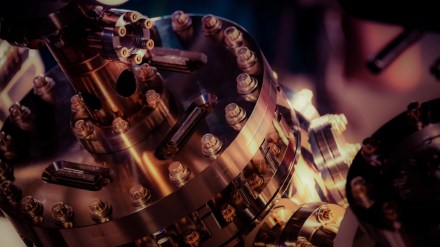

Quantum computing is a groundbreaking technology that goes beyond the capabilities of traditional computers. While regular computers use bits to process information as either a 0 or a 1, quantum computers use quantum bits, or qubits, which can be both 0 and 1 at the same time. This unique property, known as superposition, along with entanglement — a phenomenon where qubits become interconnected and the state of one instantly influences the state of another — allows quantum computers to do complex calculations at unprecedented speeds. Quantum computing has the potential to transform the financial sector by solving complex optimisation problems more efficiently, leading to improved asset management and risk mitigation strategies.

Not all of our financial regulators are at the same level of comprehension of emerging technologies. While cybersecurity and artificial intelligence (AI) are buzzwords in regulatory circles, quantum is yet to debut — a unknown risk, as financial regulators would term them.

Regulatory lag could pose further challenges, with outdated frameworks failing to address quantum computing’s capabilities, leading to compliance issues and fragmented global regulations. Economic inequality may worsen, as larger institutions and technologically advanced countries gain a disproportionate advantage. National security threats could also arise, with potential for economic espionage and financial warfare by nations equipped with quantum technology.

The US and China have been investing large amounts to race towards a quantum-pole position. IBM is expected to achieve the 1,000 qubit quantum capability later this year. While the Indian Quantum mission has been announced, it has a funding allocation of less than what a medium-sized bank’s payroll cost.

The Reserve Bank of India, Securities and Exchange Board of India and Insurance Regulatory and Development Authority of India must urgently develop their own understanding of quantum computing and ensure the institutions they oversee are prepared for this breakthrough. Quantum computing will alter the landscape of financial operations, risk management, and cybersecurity. Regulators need to understand these changes to create effective policies and standards that safeguard financial stability.

Quantum computing’s ability to rapidly solve complex problems and process large data sets can alter market dynamics, necessitating regulators to ensure stability and prevent systemic risks. As quantum advances threaten current cryptographic methods, regulators must adapt financial systems to post-quantum cryptography to protect sensitive data and maintain trust.

In financial services and public finance, any cyberattack or data breach would simply mean that all client data of private citizens and governments can be accessed. The attacker, be it a state-sponsored or non-state actor, can further tamper and manipulate manipulate encrypted records and also create fraudulent transactions.

Regulators should invest in education and training programmes, collaborate with industry stakeholders, and support relevant research. Developing policies and guidelines for the adoption of post-quantum cryptographic methods and secure quantum algorithms is crucial. Additionally, comprehensive risk management strategies, including scenario planning and stress testing, are essential to identify, assess, and mitigate potential risks.

For financial regulators, risks can outweigh all other positives of a new technology or process. They strive to achieve risk resilience. For example, the Monetary Authority of Singapore advised its regulated entities on quantum risks and asked them to create an inventory of cryptographic assets and to identify assets to be prioritised for migrating to quantum-resistant encryption.

Developing new regulatory frameworks around quantum computing, with as much fervour and urgency as AI, is needed. While one might think that quantum dangers are years away, just one bad actor attempting to destabilise a system — national or private — will send shock waves across the sector.

To safeguard the pillars of financial stability and to maintain resilience, regulators must bring urgent attention to quantum computing. This technology will redefine the landscape of risk and opportunity, and our preparedness today will determine the resilience and trustworthiness of our financial systems tomorrow.

The author is a Policy researcher and corporate advisor

X: @ssmumbai

Disclaimer: Views expressed are personal and do not reflect the official position or policy of FinancialExpress.com. Reproducing this content without permission is prohibited.