The Honda–Nissan merger was one of the biggest talking points about a month ago which could potentially be the foundation stone to one of the biggest conglomerates in the global auto industry. If things fall into place, the merger can come into being by 2026. However, before it can actually take shape, Honda has put in a serious condition in front of Nissan.

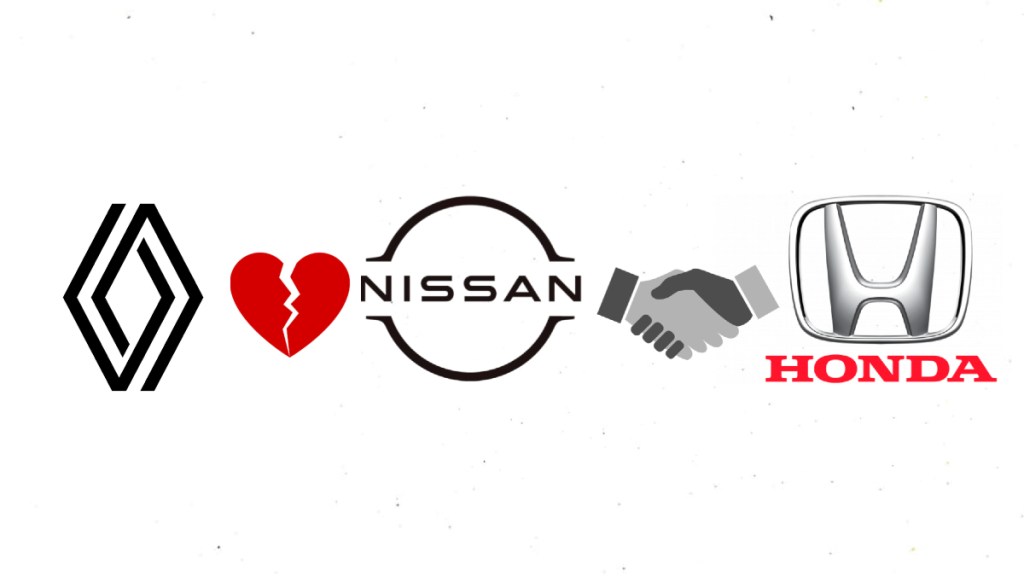

We already know that Nissan, Renault and Mitsubishi have a well established alliance. While Mitsubishi has agreed to be part of the new venture involving Honda and Nissan, the presence of Renault may cause a hurdle for the upcoming merger.

Nissan to buyout Renault’s stake

According to a recent Bloomberg report, Honda has urged Nissan to end its alliance with Renault, according to a recent Bloomberg report. This would require Nissan to purchase Renault’s stake in the company. Currently, Renault holds a 35.7% share in Nissan, making it the largest single shareholder. At its peak, Renault’s stake in Nissan was 43%, but this has decreased following several share sales in 2023 and 2024.

So far, neither Honda nor Nissan has issued an official statement about the potential buyout. The transaction would involve a substantial sum of Rs 31,457 crore, posing a significant challenge for Nissan given its current financial situation. During the first half of the Japanese financial year (April 1 to September 30), Nissan recorded an operating profit margin of just 0.5%, reflecting a year-over-year decline of approximately 90%.

This data suggests that Nissan may lack the necessary cash or liquid assets to purchase Renault’s stake at this time. However, it does not ascertain whether this is a binding condition by Honda moving forward towards the merger. Honda could be concerned about Renault’s stake in Nissan, as foreign entities may be looking into buying these shares.

For instance, the recent report indicates that Taiwan-based Foxconn is exploring the possibility of acquiring Renault’s stake in Nissan. Foxconn, a prominent manufacturer of electronic products for major brands like Apple, Microsoft, Dell, Sony, Google, Amazon, and Nintendo, is keen on this acquisition as part of its strategy to enter the electric vehicle (EV) market. However, initial discussions between Foxconn and Nissan failed to result in a mutually agreeable deal.

The Renault–Nissan–Mitsubishi alliance came into being with Renault and Nissan joining forces in 1999. Mitsubishi came on board later in 2016. This partnership operates through a cross-shareholding arrangement rather than a traditional merger or acquisition.

Source: Bloomberg