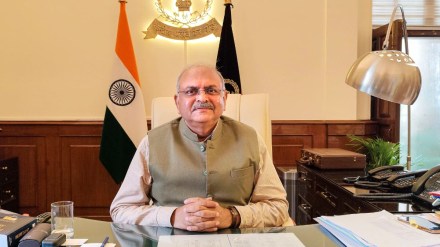

The government is hopeful of achieving the budgeted direct tax collection target for 2025-26, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal said on Monday. The government has set a budgeted target of Rs 10.82 lakh crore for corporate tax and Rs 14.38 lakh crore for personal income tax for the current financial year.

When asked about the wide differential between the budgeted pace of direct tax collections and the mop-up in H1, Agrawal said, “This is a continuous process… The due date for filing tax returns has now been extended to December 10, when more self-assessment tax will also come in. Then, going forward, December 15 and March 15 are the next advance tax collection dates. Taken together, I’m confident that by the end of the year we would meet the target.”

Direct tax collections stood at over Rs 12.92 lakh crore up to November 10, helped by higher corporate tax mop-up and slower issuance of refunds. Gross collections (pre-refunds) grew just 7% year-on-year during this period.

On the delay in issuance of refunds, Agrawal said the government is analysing certain high-value or system red-flagged refund claims. “We hope to release the remaining refunds by this month or December,” he added while inaugurating a taxpayers’ lounge at the India International Trade Fair (IITF).

The Centre has pegged direct tax collection growth of 13.2% to Rs 25.2 lakh crore for FY26, compared with Rs 22.26 lakh crore collected in FY25, despite substantial income tax relief announced in the budget.