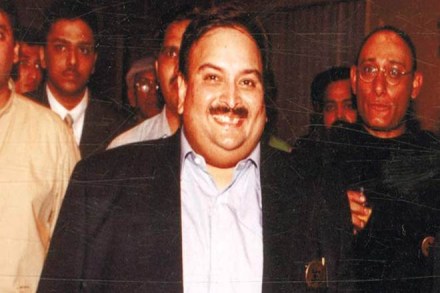

Promoter of Gitanjali Group Mehul Choksi and his diamond merchant nephew Nirav Modi had left India in January this weeks before the multi-crore Punjab National Bank (PNB) fraud case came to the fore. While the news bewildered many from within the industry, the company was involved in illegitimate business transactions. A Dubai-based subsidiary firm in 2015 had informed vice-president of Gitanjali Group Vipul Chitalia about possible legal consequences if customs authorities found that the company was “low quality” coloured gems at highly inflated value to Dubai, according to an Indian Express report. Chitalia has been put behind bars.

In an email sent by the Dubai-based subsidiary to Chitalia and other officials of Gitanjali Group on October 6, 2015 “We apprehend that in a surprise check, if customs in Dubai/ India open the parcel, the company will be heavily penalised.” The company also said that these “low quality stones release colour and the bag inside which stones are kept turns red”, as per IE report. The Gitanjali Group sells popular branded jewelleries like Nakshatra, Gilli, Asmi and D’damas.

It was Choksi, who used to fix the rates of goods which were exported by the group, according to IE report. He used to rotate the same consignments several times only to inflate the turnover of Gitanjali Group. By doing so, he managed to acquire higher bank credit and siphon funds. The Enforcement Directorate (ED) has found that the fair value of the diamonds, gems and jewellery seized by it from Choksi’s showrooms and factories in Mumbai and Hyderabad is just over one-fourth of their total book value.

Both Choksi and his nephew Nirav Modi are wanted by multiple investigating agencies in conection with Rs 13,600 crore through fraudulent issue of letters of undertaking (LoUs) and foreign letters of credit (FLCs). While officially both of them are absconding. However, reports say that Choksi is in the US.

The Enforcement Directorate on Thursday said it has filed a prosecution complaint before a special Prevention of Money Laundering Act (PMLA) court here against Gitanjali Gems owner Mehul Choksi in connection with the multi crore Punjab National Bank (PNB) fraud case, the agency said. The complaint charged Choksi and 13 others – eight individuals and five companies – under section 4 of the Act for the offence of money laundering. “ED files prosecution complaint against Mehul Choksi and others including M/s Gitangali Gems Pvt Ltd, M/s Gili India Ltd, and M/s Nakshatra Brand Ltd in Bank fraud case,” the agency said in a tweet.