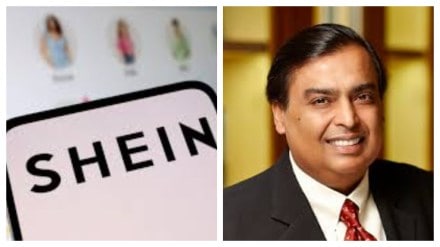

Two of the country’s biggest conglomerates – Reliance and Tata – will face off in the value fashion market following the relaunch of Shein in India after five years.

The Chinese fast-fashion brand, ranked among the world’s largest fashion retailers, with sales in excess of $30 billion, staged a low-profile comeback last weekend in Mumbai, Thane, Navi Mumbai, Delhi and Bengaluru in partnership with Reliance Retail. The comeback was via a website and app, crossing 10,000 downloads within four days of relaunch on Google Playstore and prompting shares of rival Trent to see its biggest single-day fall – 6.2% on the BSE and 6.4% on the NSE — in three months on Tuesday.

Trent was also the top loser on the Nifty50 Index during the day as investors remained nervous of heightened competition in the $65-billion value fashion market in India. This segment has been the fastest-growing over the last few years at 12-15% per annum, say experts, as players such as Trent’s Zudio, Shoppers Stop’s Intune, Aditya Birla Retail’s Style Up and Reliance Retail’s Yousta tap aspirational young consumers and families with trendy garments priced affordably.

Trent, however, remains the largest player in the category with over 577 Zudio stores across India, focusing on the 18-35 age group, with price points ranging from Rs 200-Rs 1,500 across men’s and women’s wear.

Sources in the know told FE that Shein will also keep its focus on young consumers — 15-35 years of age– with price points in the range of `199-2,000 apiece for men’s and women’s wear. An offline foray is likely in the coming months, tapping Reliance Retail’s large store network. The country’s largest organised retailer may also look to cross-sell Shein clothing on Ajio as it seeks to leverage its online presence to maximise sales. Reliance Retail executives were not immediately available for comment.

Allaying concerns around Chinese platforms, Nextgen Fast Fashion, the company that will manufacture, market and distribute Shein products in India, will have no equity ownership of Shein, sources said. Netgen will remain a wholly-owned subsidiary of Reliance Retail, with the latter ensuring localisation of infrastructure and platform data to ensure that the partnership with Shein is compliant with Indian laws and regulation.

Reliance Retail is also working with Shein to develop a completely localised model for digitising supply chain of Indian SMEs and factories. This comes as garments and accessories sold on the Shein app will be sourced from Indian companies, sources said.

Nextgen is also scaling up the network of local manufacturers so that India can become a supply source for Shein’s global operations in future. Nextgen is also ensuring that the country of origin for products listed on its app and website would be Indian.