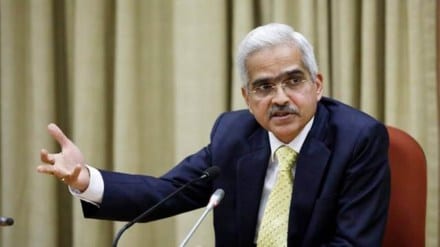

The Reserve Bank of India’s (RBI) monetary policy committee (MPC) on June 8 voted to keep benchmark repo rate unchanged at 6.50% and retain the focus on the ‘withdrawal of accommodation’ stance. While the MPC has opted to pause, it does not mean a pivot, and the RBI’s future actions will be dependent on evolving global and domestic macroeconomic situation, governor Shaktikanta Das said. Excerpts from the RBI’s post-MPC press meet:

When will CBDCs be launched for public use?

T Rabi Sankar: We have not planned for any specific date. Like we mentioned earlier, this will be a gradual and calibrated process because we want to assess the impact, learn as we go, and take it ahead. For now, the plan is that by the end of June, we should have 1 million customers. Secondly, we are planning to make CBDC QR code interoperable with UPI.

What amount of excess rupees has been parked by foreign banks in India’s bond markets?

Governor Das: …the process has already started. As regards investment in Indian securities or bonds, naturally this being the first time, the central banks as well as banks on the other side are seeking further clarity and we expect the process to begin soon.

Is the RBI looking to launch a detailed circular on banks’ fraud classification norms?

MK Jain: The Supreme Court has given its judgment that a natural justice has to provided to the borrower before declaring the fraud. Subsequently, SBI filed a review petition and the SC clarified that there is no need for giving a personal hearing. So, we are reviewing entire guidelines on fraud, in consultation with various stakeholders, and we will come out with our guidelines very shortly. The Supreme Court judgment is applicable to all the regulated entities irrespective of RBI guidelines.

What action is RBI taking against unauthorised apps?

Also read: Multi-cloud app security: F5 looks at India

Michael Patra: There is actually a two-pronged approach to this. One is to build up levels of awareness, and for that purpose the RBI not only issues list of unauthorised platforms, we also give you a list of authorised platforms. The other thing that we do is to interact very closely with enforcement agencies and the ministries like information technology and finance. They are taking action on an ongoing basis. Already, we are hearing about various platforms being raided and assets seized, so action is taking place. Third line of action should be that tech companies which are uploading those mobile apps should apply caution and ensure that what they are uploading is in accordance with the laws of the land.

Can you provide updates on ECL model implementation?

DG M Rajeshwar Rao: We have received comments from all stakeholders, they are still being evaluated. Some more refinements and work need to be done. So, at this point in time, I do not think it is correct to infer that June 30 would be the date that it is going to be launched.

Governor Das: If you look at our track record, we give time for compliance. Banks should be given time to brace for the impact of expected credit loss (ECL) and we will give them sufficient time for implementation.