The story of an investor from Chandigarh, who discovered unclaimed Reliance Stocks worth 11 lakh after 37 years, has gone viral. Rattan Dillon, a car enthusiast, recently stumbled upon an unexpected treasure while spring cleaning—physical copies of Reliance Industries Limited (RIL) shares bought in 1988.

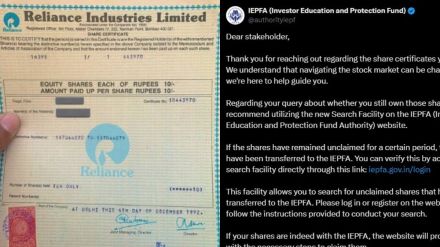

Now when he sought help online, several X users came forward with valuable yet funny suggestions, including the Investor Education and Protection Fund Authority(IEPFA). The IEPFA Authority, which is entrusted with the responsibility of administration of IEPF, making refunds of shares, unclaimed dividends, matured deposits/debentures etc. to investors, replied to Dillon’s post.

“Dear stakeholder, Thank you for reaching out regarding the share certificates you found. We understand that navigating the stock market can be challenging, and we’re here to help guide you.

Regarding your query about whether you still own those shares, we recommend utilizing the new Search Facility on the IEPFA (Investor Education and Protection Fund Authority) website,” It wrote.

The IEPF in its reply also mentioned that: “This facility allows you to search for unclaimed shares that have been transferred to the IEPFA. Please log in or register on the website and follow the instructions provided to conduct your search.

Step-by-step guide to claim forgotten or unclaimed shares

If you come across forgotten shares, the process to claim them depends on whether a nominee was designated by the original account holder. Here’s how you can proceed in different scenarios:

Scenario 1: If a Nominee is Assigned

- Submit the Necessary Documents: If the original shareholder assigned a nominee, the nominee must initiate the process by filling out a transfer form. This form can be obtained from the depository participant or downloaded from their website.

- Provide Certified Death Certificate: The nominee must submit the certified death certificate of the deceased shareholder along with the transfer form.

- Verification of Documents: Once the submitted documents are verified by the depository participant, the shares will be transferred to the nominee’s depository account.

- Multiple Claimants: If there are multiple legal heirs or claimants, the transfer process may become more complicated and may require legal intervention to resolve disputes.

Scenario 2: If No Nominee is Assigned

- Review Existing Documents: If no nominee was assigned, the bank or financial institution handling the shares will first check for any legal documentation, such as the deceased holder’s will.

- Submit the Will: If a will is available, it will serve as the primary document guiding the distribution of the shares. The designated heirs can proceed with the claim based on the instructions in the will.

- Succession Certificate (If No Will): If there is no will, the claimant(s) must obtain a succession certificate from the court, which legally establishes their right to inherit the shares.

- Legal Heir Agreement: To avoid disputes, all legal heirs should come to an agreement on how the shares will be distributed. This agreement should be presented to the court for approval.

- Submit Legal Affidavits: Each heir will be required to submit a legal affidavit confirming their claim to the shares. The court will then process the transfer based on the verified claims.

Importance of Legal Clarity

To ensure a smooth transfer and avoid potential disputes, it’s essential that all legal heirs are clear on the distribution process.