Low prices and dumping of sub-standard steel were hurting the domestic steel industry, steel secretary Sandeep Poundrik said on Tuesday. Domestic steel prices are running at an almost five-year low, Pondrik said, underlining that, “while the prices were too high five years ago, they are now lower than where they should have been.”

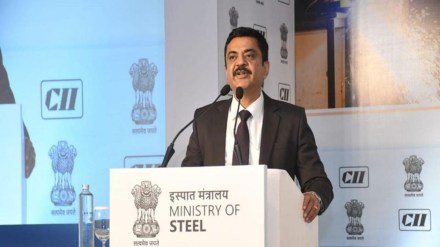

Addressing the Confederation of Indian Industry (CII) Steel Summit 2025, Poundrik called prices a major challenge as India is looking to add new capacity in the sector at a rapid pace. Poundrik said about 150 smaller firms have stopped production due to low prices.

“We would be adding around 100 million tonnes every five to seven years, positioning India to not only meet domestic demand for the key building, industrial and infrastructure input but also emerge as a global leader,” he said.

As of October 26, local steel prices slumped to a five-year low, trading in the range of Rs 47,000-48,000 per tonne for hot rolled coil, as per BigMint. Although the lower prices may provide a temporary benefit to downstream steel consumers, including automobile manufacturers, white goods producers, and railways, steelmakers are facing serious profitability issues.

The secretary said that the steel ministry is working closely with the ministry of coal to increase the share of domestic coking coal in steel making, ensuring greater self-reliance and security in raw material supply. About 90% of coking coal in the country is being imported.

Referring to surplus production of steel in the world and consequent dumping in India, Poundrik said dumping is a real problem and impacting the prices in the domestic market. With the new US tariff on steel, countries like China and South Korea are believed to be looking for alternative markets, including India, which raises the spectre of low-priced imports.

“The government is also taking proactive measures to ensure that cheap and substandard steel does not flood the Indian market. Through Quality Control Orders, we are creating a level playing field where both domestic and foreign producers meet the same quality benchmarks”, he said.

According to reports, imports of finished steel in the first half of the current fiscal year stood at 3.3 million tonnes (MT), down 29% year-on-year, while exports increased by 22% to 2.8 MT.

Highlighting the trade barriers like the Carbon Border Adjustment Mechanism (CBAM) of the European Union, the secretary said that the “Direct Reduction of Iron (DRI) plus Hydrogen” route offers a promising pathway for green steel production. With hydrogen prices declining faster than anticipated, India could see hydrogen become a viable alternative to natural gas within the next 5 to 10 years, making this route central to our decarbonisation and global competitiveness goals, he stated. The secretary also said that the government has started pilot projects with steel companies for the same.