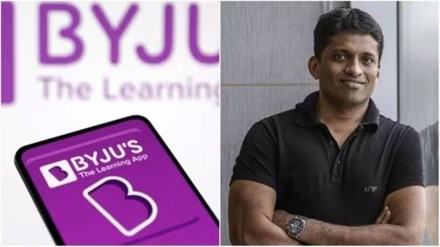

Ahead of the Friday’s extraordinary general meeting (EGM), the leadership team of Byju’s has opened communication channels with a group of miffed investors who are pressing for a change in management, including the ouster of founder-CEO, Byju Raveendran.

Sources said that Byju’s leadership team has conveyed about putting in place a transparent mechanism to monitor the end-use of funds raised through its ongoing rights issue.

Byju’s is learnt to have received a commitment of $300 million from investors so far for the rights issue, which will close by the end of February. The issue was floated in January-end to raise $200 million at an enterprise valuation in the range of $220-250 million, a 99% reduction in its peak valuation of $22 billion.

The reaching out of the senior management to the miffed investors assume significance because it wants them not to press with their demand of change in the leadership. It also wants them to invest in the rights issue. Byju’s has also offered to appoint two independent directors to enhance transparency after the rights issue.

Byju’s three-member board currently comprises, Raveendran, his wife Divya Gokulnath, and his brother Riju Raveendran.

To oust the board, majority –50% plus one share – of votes cast should be in favour of the resolution. Raveendran and his family are the largest shareholder with a 26% stake in Byju’s and will vote against the proposal.

According to rules, two members should be present at the EGM to form the quorum for the meet. Byju’s articles of association mandate the presence of its promoter-director at the EGM and if the person doesn’t turn up at the meeting, the EGM can be adjourned for a week. At the adjourned EGM, even if the promoter-director is not there, the shareholders present at the meeting can form the quorum.

The group of investors, who have given notice for the EGM, together own over 25%, but won’t participate in the meeting as they do not have voting rights. This is because they had signed a shareholder agreement that does not give them voting rights. Other shareholders own over 45% in Byju’s.