Nvidia’s latest results clearly show that its chip sales for AI work grew even more than what market experts had predicted. The strong numbers, shared on Wednesday night, offer some comfort to investors who were worried that the current tech boom might suddenly slow down and hurt the world’s biggest AI companies.

So the new quarterly report, which covers August to October, brought relief to those worried about a sharp slowdown. In fact, it may also help steady the stock market after its recent dip.

Nvidia Results – 5 key takeaways

Record revenue as AI demand soars and data center growth

Nvidia reported its highest-ever revenue of $57 billion. This is 22% higher than the previous quarter and 62% higher than the same time last year. Its Data Center business also hit a new record with $51.2 billion in sales, up 25% from last quarter and 66% from last year. The company said its profit margins were very strong at about 73%.

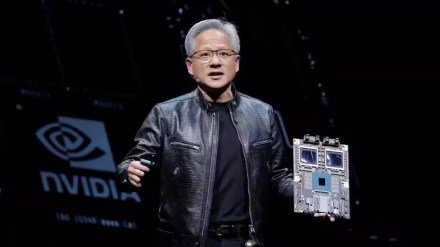

Earnings per diluted share came in at $1.30 under both GAAP and non-GAAP measures. CEO Jensen Huang said that demand for Blackwell chips is extremely high and cloud GPUs are already sold out. He added that the need for computing power is rising quickly in both training and inference, and both are growing at a very fast pace.

Huang said that the industry had entered a “positive cycle” for AI. He noted that the AI market is expanding rapidly, with more model developers, more start ups and more industries and countries adopting the technology. According to him, AI is spreading everywhere and being used for almost every kind of work.

Earnings per share: $1.30 adjusted vs. $1.25 estimated

Revenue: $57.01 billion vs. $54.92 billion estimated

Nvidia posts strong profits and boosts shareholder returns

Nvidia returned $37 billion to its shareholders this year through stock buybacks and dividends, and it still has $62.2 billion set aside for more buybacks in the future. The company will pay its next quarterly dividend of $0.01 per share on December 26, 2025, to those who hold shares as of December 4, 2025.

The company’s operating income reached $36.01 billion, a 27% jump from the previous quarter. Net income rose to $31.91 billion, up 21% from last quarter and 65% from last year. On a non-GAAP basis, operating income was $37.75 billion, up 25% from Q2, while non-GAAP net income was $31.77 billion, an increase of 23%. Non-GAAP diluted earnings per share were $1.30, up 24% from Q2. Market Domination Overtime’s Josh Lipton highlighted the company’s strong data center performance and positive outlook.

Company guidance

Nvidia shared a strong outlook for the current quarter, with CEO Jensen Huang saying demand for the company’s Blackwell AI platform is extremely high. Nvidia expects revenue of about $65 billion for Q4 2026, higher than the market’s expectation of $61.55 billion.

The company expects sales guidance for the fourth quarter to be around $65 billion, with a possible swing of 2% either way. It is forecasting gross margins of about 74.8% under GAAP and 75% under non-GAAP, with a small margin of variation. This clearly indicates that the AI spending spree will not slow anytime soon.

Operating expenses are expected to be about $6.7 billion under GAAP and $5 billion under non-GAAP. Other income is expected to be around $500 million, not counting gains or losses from certain equity investments. Nvidia also expects a tax rate of about 17%, with a 1% range either way.

‘Blackwell sales off the charts’

Huang said that sales of the Blackwell chips are “off the charts” and that cloud (computing) GPUs (graphics processing units) are already sold out. He explained that the need for computing power is rising quickly and building on itself, both in training and in inference, with both areas growing at an extremely fast pace. He said the industry has now entered a strong growth cycle for AI.

According to Huang, the AI ecosystem is expanding quickly, with more developers creating new foundation models, more start-ups entering the field, and more industries and countries adopting the technology. He added that AI is spreading everywhere and being used for many kinds of tasks at the same time.

Blackwell chips offer major boosts in AI speed and efficiency. They come with a new Transformer Engine that can handle 4-bit precision, which makes it much quicker to train and run very large AI models.

The chips also provide up to 30 times better performance for inference while using much less power, allowing companies to reduce both energy use and costs. Big cloud companies, server manufacturers, and AI firms such as Meta have already started using them to train and run advanced models.

These chips also include strong security tools to protect important data. Blackwell is designed to support the next wave of AI systems, from improved research technologies to fast and responsive AI assistants.

Margin expansion

Nvidia expects its adjusted gross margin to be around 75% for the quarter, with a small range of variation. The company’s finance chief, Colette Kress, said they aim to keep margins in the mid-70% range during fiscal year 2027.

In the third quarter, Nvidia’s revenue jumped 62%, marking the first time in seven quarters that its growth rate picked up again. As stated above, its data-center division, which brings in most of its income, reported $51.2 billion in sales for the quarter ending October 26, while analysts had predicted $48.62 billion.

What’s noteworthy is that Nvidia’s strong results also lifted the stock prices of competitors like AMD and major tech companies such as Alphabet and Microsoft.

Are these results enough to quash AI bubble fears?

Some analysts told Reuters that the latest earnings report might still not ease worries about a possible AI bubble. Stifel analyst Ruben Roy said fears about whether AI infrastructure spending can keep growing are unlikely to fade. In the third quarter, Nvidia sharply increased its spending on renting back its own chips from cloud companies that cannot lease them out to others. These agreements reached $26 billion, more than twice the amount from the previous quarter.

Tech giants like Microsoft and Amazon continue to pour billions into AI data centers. Some investors believe these companies may be boosting their earnings on paper by extending the depreciation period of AI hardware such as Nvidia’s chips.

Nvidia’s revenue has also become more concentrated. In its fiscal third quarter, just four customers made up 61% of its sales, compared with 56% in the previous quarter.

The company has been investing heavily in AI start-ups as well, putting billions into firms that are also major buyers of its products. This has raised concerns about a self-reinforcing “circular” AI economy. In September, Nvidia agreed to invest up to $100 billion in OpenAI and supply it with data-center chips.

Kinngai Chan of Summit Insights told Reuters that even though Nvidia’s results and guidance were better than expected, many investors may still worry about whether customers can keep raising their capital spending and about the loop of money flowing within the AI sector.