Tanishq and De Beers have a tough task ahead. The Indian jewellery retailer has joined forces with De Beers Group, a global leader in diamond mining and retailing, to champion natural diamonds through an educational campaign. Through extensive direct and in-person customer outreach in a phased city-wise rollout through Tanishq’s stores, this collaboration aims to reach every corner of the country over the next 18-20 months.

“The plan is to promote a better understanding of the 4 Cs of diamonds as well as properties beyond that, such as brilliance, light performance, fluorescence etc. The target is to engage over 1 million customers in the next 18-20 months. There will be a thorough demonstration on the authenticity of natural diamonds with state-of-the-art, simple-to-use equipment developed by De Beers across multiple catchments and towns,” reveals Ajoy Chawla, CEO, Jewellery Division, Titan.

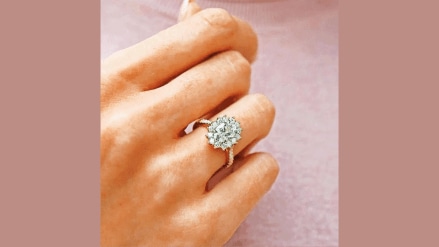

If Tanishq plans to roll out a 360-degree above-the-line marketing campaign to fan the latent desire for Tanishq diamonds, De Beers hopes to engage prospective customers with content developed and curated for digital and social channels. “In India, diamonds are not just a luxury; they are an emotional and cultural investment, often marking life’s most important moments. However, the rise of LGDs, which are often indistinguishable from natural diamonds to the naked eye, has created confusion among buyers,” adds Chawla, while emphasising the importance of consumer education in this space.

According to a spokesperson from the Gem & Jewellery Export Promotion Council (GJEPC), “As the price gap between natural diamonds and lab-grown diamonds continues to widen, it becomes even more critical that consumers are aware of the distinctions.”

Trends back home reflect global demand for LGD. The natural diamond market is currently valued at around $85 billion, while the LGD market is expected to reach $29 billion by 2025. The market share of LGDs in India is much smaller compared to natural diamonds, but the challenge posed by the segment is difficult to ignore. Sandrine Conseiller, CEO of De Beers Brands, says, “Our objective is to ensure that consumers are equipped with the right information to make an informed choice that resonates with them both emotionally and ethically.”

Whether it’s lab-grown or natural, a diamond must meet stringent certification criteria, including the 4Cs: cut, clarity, colour, and carat. Ensuring that the consumer is buying a fully certified stone is paramount. “Consumers today are not just concerned about the aesthetic value of the diamond but also how it is sourced, whether it’s mined sustainably, and the ethical considerations behind it,” Chawla reasons.

While there is a growing demand for transparency, educating consumers about the differences between natural and lab-grown diamonds is not without its challenges. Praveen Govindu, partner at Deloitte India, explained the difficulty in getting the message across in such a competitive market. “While lab-grown diamonds are often marketed as more environmentally friendly and affordable, natural diamonds hold a certain allure due to their rarity and historical significance. Our role, and the role of the jewellery industry, is to make these distinctions clearer,” he says.

This education is crucial for jewellers as well. “Retailers will need to focus on which segment of the market they want to target. Some will cater exclusively to natural diamonds, while others may diversify into lab-grown to appeal to a wider audience,” Govindu adds.