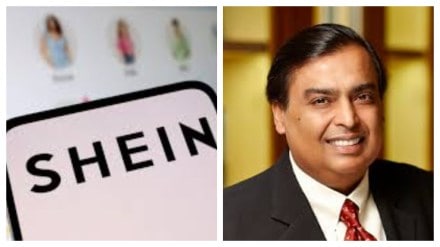

Shein, the global fast-fashion brand, has made its return to India with a dedicated mobile app, nearly five years after being banned in 2020. The app, launched by Reliance Retail, is now available on Android and iOS, initially serving customers in New Delhi, Mumbai, and Bengaluru. A nationwide rollout is planned in the coming months.

Shein’s Comeback After 2020 Ban

Shein was among several Chinese apps banned by the Indian government in 2020 due to concerns over data security and national interest. Before the ban, the platform had gained popularity for its affordable, trendy clothing, particularly among young shoppers. Its sudden exit left a gap in the Indian fast-fashion market, later filled by local brands and international competitors like H&M and Zara.

In 2023, Shein announced its re-entry into India through a strategic partnership with Reliance Retail. Under this agreement, Shein does not hold any equity in the Indian operations. Instead, Reliance Retail has full control over manufacturing, operations, and data sovereignty, while Shein functions as a technology partner and earns a licensing fee for brand usage.

India-First Manufacturing and Pricing

Unlike its previous business model, where Shein imported products, the new venture relies entirely on local manufacturing. All Shein-branded products sold in India will be designed and produced by Indian manufacturers, in line with the government’s “Make in India” initiative.

The pricing remains competitive, with dresses starting at Rs 199, making it accessible to budget-conscious shoppers. This positions Shein as a strong player in India’s growing fast-fashion segment.

Reliance’s Role in the Relaunch

Reliance Retail, India’s largest retailer, is overseeing Shein’s entire supply chain, including sourcing, logistics, and data protection. This structure ensures compliance with Indian regulations and addresses previous concerns over data security.

With Reliance’s vast retail network and Shein’s brand appeal, the partnership is expected to reshape the online fashion market in India. Analysts see this as a strategic move that leverages Shein’s brand recognition while ensuring that all operations remain within India’s regulatory framework.

What’s Next?

As Shein resumes operations in India, it will compete with established online fashion players such as Myntra, Ajio, and Tata Cliq. The brand’s affordability, combined with Reliance’s retail expertise, could give it a strong advantage in the market.

For now, Shein is focusing on its initial launch in three major cities, with a broader expansion planned soon. The response from Indian consumers will determine how quickly Shein can regain its position in the fashion industry.