New, homegrown ice cream brands are working on making the ubiquitous dessert a little less indulgent, as people look for healthy ice cream alternatives. Nomou, Minus 30, Noto, Get-A-Whey, and The Brooklyn Creamery are some of the brands making plant-based, low-calorie, and/or high-protein ice creams.

India’s organised ice cream market was worth Rs 13,800 crore in 2019, according to Deloitte. This category is expected to grow at a CAGR of 10.5% over the next three years. While healthier variants of food products have been sought after during the pandemic, can these new-age ice cream brands stand up to legacy ones such as Amul, Mother Dairy, Havmor, and Kwality Wall’s?

The sweet spot

Nomou started off as a vegan ice cream brand in 2018, and partnered with just one restaurant that had a vegan menu. “Slowly, more restaurants and cafes wanted to add our range of ice creams because customers sought out healthy variants,” says Samir Pasad, founder, Nomou.

As the HoReCa segment remained shut for the better part of 2020, Nomou began retailing its products in June 2020. Now, the brand retails through food delivery aggregators Swiggy and Zomato, sells directly to consumers through its own website, and is present in modern trade outlets like Nature’s Basket and Foodhall.

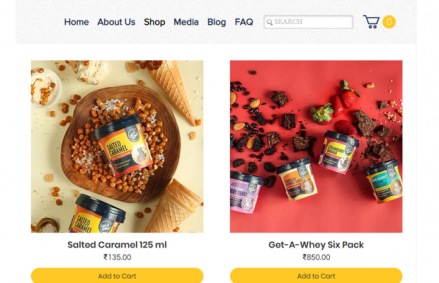

Pashmi Shah, co-founder, Get-A-Whey, launched the whey-based ice cream alternative about two years ago, targetting fitness enthusiasts, people with diabetes, and those on a keto diet. She says the company sold over 50,000 units of ice cream tubs between 2019 and 2020. This number has grown four times since the pandemic, and the company makes about Rs 5 crore per annum now.

Minus 30 sells a range of sugar-free and vegan gelatos, in addition to mainstream ice creams that include refined sugar. Shivanie Mirchandani, its co-founder, says that the healthy variants are more popular than the regular ones. The company has two manufacturing hubs in Delhi and Chennai from where it serves 15 markets.

Healthy competition

Brands that sell healthy, low-calorie variants of ice creams price their products at a premium. For instance, a 500 ml tub of Nomou ice cream could cost between Rs 445 and Rs 700, a Keto ice cream from Get-A-Whey costs Rs 650 for a 500 ml tub, and Minus 30 charges Rs 1,000 for 500 ml of vegan, sugar-free gelato. This price point limits the addressable market for these brands. In contrast, a 1000 ml tub of Amul ice cream costs about Rs 200. Prasad of Nomou says the company is working on reducing prices by increasing manufacturing capacity and finding alternative ingredients.

Cold chain logistics is the biggest hurdle for these brands. Most have just one manufacturing facility and send products across the country from one or two hubs. For instance, Noto, which delivers only in Mumbai, takes 24 hours to deliver when an order is placed on its website. Creating a strong distribution network will be crucial to winning new customers.

Analysts believe it will take some time for these brands to challenge established players that are also working on low-sugar variants. “These are micro brands that do not have the wherewithal to reach a large market,” says Harish Bijoor, founder, Harish Bijoor Consults. These brands could leverage a network of cloud kitchens to strengthen their reach, he adds.

Going direct-to-consumer may have worked in favour of these brands, but having a prominent presence offline is what is required next, say analysts. “Being present at more outdoor consumption points like modern trade, malls, airports, etc, will be crucial for these brands,” says Anand Ramanathan, partner, Deloitte India.

Read Also: How brands can stand out during festival sales