Michael Burry has never been the kind of man who whispers. When he sees a bubble forming, he warns loudly, even if no one wants to hear it.

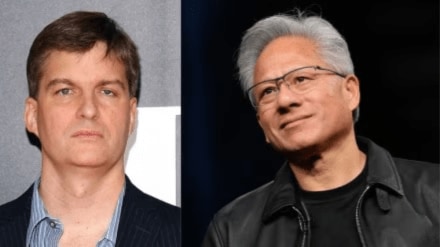

And now, NVIDIA is in his crosshairs. After weeks of hinting doubts toward the AI chipmaker, Burry has made NVIDIA the first major subject of his new project, a paid Substack blog.

He has launched his subscription-based Substack, “Cassandra Unchained,” a title loaded with meaning.

The blog, according to its description, is now his sole focus and promises readers a “front row seat to his analytical efforts and projections for stocks, markets, and bubbles, often with an eye to history and its remarkably timeless patterns.”

Calling the AI boom a “glorious folly”

The piece, titled “The Cardinal Sign of a Bubble: Supply-Side Gluttony,” takes direct aim at the narrative that the AI boom is different from the dot-com frenzy of the early 2000s.

Though many investors argue today’s tech giants are fundamentally stronger because they are profitable, Burry reminds them that history is not as distant or different as it seems.

At the height of the dot-com era, he writes, the Nasdaq was driven by “highly profitable large caps, among which were the so-called ‘Four Horsemen’ of the era, Microsoft, Intel, Dell, and Cisco.” Back then, the flaw was not enthusiasm — it was excess.

He writes that there was “catastrophically overbuilt supply and nowhere near enough demand,” and despite people trying to argue that today’s AI boom is different, Burry says it’s “just not so different this time, try as so many might do to make it so.”

Burry goes further, comparing today’s key players, Microsoft, Google, Meta, Amazon, Oracle and rising AI-centered startups like OpenAI, to the leaders of the dot-com age. But it is NVIDIA that gets the sharpest spotlight.

“And once again there is a Cisco at the center of it all, with the picks and shovels for all and the expansive vision to go with it. Its name is Nvidia.”

Cisco, of course, fell 78% during the dot-com crash.

Burry signs off that post with a quote by Charlie Munger, “If you go around popping a lot of balloons, you are not going to be the most popular fellow in the room.”

Burry’s first post, ‘Foundations: My 1999 (and part of 2000),’ takes readers back to his time as a neurology resident at Stanford University Hospital, a period when medicine filled his days and value-investing filled his nights. That double life eventually became the foundation of Scion Asset Management.

Writing again, he admits, feels like returning to a neglected but familiar path. “As I devote myself to Cassandra Unchained, I find myself on an old road not taken. I feel lucky, and I am grateful for the opportunity as I walk it again.”

About his new blog

He announced the launch of his blog on X, where he goes by “Cassandra,” the mythical prophetess cursed to tell the truth but never be believed.

Warren Buffett once used the same comparison after Burry and John Paulson correctly saw the housing crisis coming years before Wall Street acknowledged it.

In the background of this shift into writing is another quiet but meaningful change, Burry recently terminated Scion Asset Management’s SEC registration, effectively closing it to outside investors.

And after disappearing from social media for more than two years, he reappeared in late October with a cryptic message implying that the AI frenzy is not just overheated, it’s a trap.