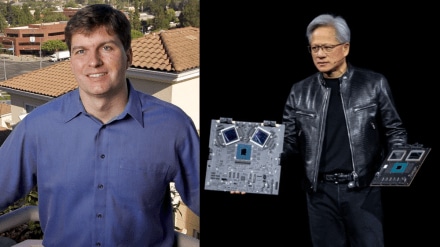

Michael Burry is doubling down on his criticism of Nvidia and the current AI boom. After shutting his hedge fund, Scion Asset Management, to outside investors and launching a new newsletter, he has been extremely vocal about what he sees as risks behind the AI boom.

Last week on X, he argued that Nvidia’s stock-based compensation was hurting shareholders, stating that it was “reducing owner’s earnings by 50%.”

He expanded on those concerns in his first Substack post, “Cassandra Unchained,” published Sunday, questioning whether Nvidia’s success can truly last. Now, Nvidia has issued a response.

Nvidia fires back at Burry

In response, Nvidia sent a memo to a Wall Street analyst that was also referenced by Barron’s. As reported by Business Insider, the note directly addressed Burry’s comments and other recent criticism.

Nvidia wrote, “Nvidia repurchased $91B shares since 2018, not $112.5B; Mr. Burry appears to have incorrectly included RSU taxes. Employee equity grants should not be conflated with the performance of the repurchase program. Nvidia’s employee compensation is consistent with that of peers. Employees benefiting from a rising share price does not indicate the original equity grants were excessive at the time of issuance.”

Burry responded on Monday via X, saying that Nvidia pushed back, writing, “I stand by my analysis. Obviously, the full analysis does not fit in a tweet. I will release on my timeline.”

Nvidia emailed a memo to Wall Street sell side analysts to push back on my arguments.

— Cassandra Unchained (@michaeljburry) November 24, 2025

I stand by my analysis. Obviously, the full analysis does not fit in a tweet. I will release on my timeline.

The first post in The Heretic’s Guide to AI’s Stars “Supply-Side Gluttony” is up…

Nvidia addresses fraud concerns

The memo also addressed claims that Nvidia’s business might resemble past corporate scandals. It stated, “Nvidia does not resemble historical accounting frauds because Nvidia’s underlying business is economically sound, our reporting is complete and transparent, and we care about our reputation for integrity.”

Nvidia further commented on concerns about circular financing in the AI sector.

The memo added, “First, Nvidia’s strategic investments represent a small share of Nvidia’s revenue and an even smaller share of approximately $1T raised each year across global private capital markets,” adding that “The companies in Nvidia’s strategic investment portfolio predominantly generate revenue from third-party customers, not from Nvidia.”

AI stock rally that pushed Nvidia to massive growth has slowed in recent weeks. Investors have become cautious due to valuation fears and uncertainty over whether current demand for expensive GPUs will last.