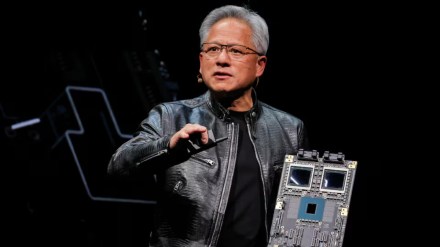

Jensen Huang, the co-founder and CEO of Nvidia, now has a net worth of over $140 billion. This comes after Nvidia became the first public company to cross a $4 trillion market value on Wednesday. According to the Bloomberg Billionaires Index, Huang is the 10th richest person in the world, and Forbes ranks him 9th on its real-time list.

Nvidia hits $4 trillion valuation

Nvidia is now the most valuable company in the AI space. Its $4 trillion valuation is equal to about 75% of India’s entire equity market and is bigger than the market value of every other country except the US, China, Japan, Hong Kong, and India.

Nvidia’s stock rose 2.5% to $164 on Wednesday. The company had a rough start to the year due to concerns about competition from China’s DeepSeek and trade tensions related to Donald Trump. But since hitting a low in April, Nvidia shares have bounced back strongly, rising 74% from its that month’s lows.

How did Nvidia’s valuation surge contribute to Huang’s net worth?

Huang owns 3.5% of Nvidia, making him the company’s biggest shareholder. His wealth has grown very quickly over the past five years. In 2022, Forbes estimated his net worth at $20.6 billion. It rose to $44 billion in 2023, then jumped to $117 billion in 2024. Now, at age 62, Bloomberg says his fortune is over $140 billion.

Nvidia’s rise to a $4 trillion valuation is the latest milestone in its steady growth, driven by strong interest in AI. So far in 2025, Nvidia’s stock is up 20%, compared to a 6% rise in the Nasdaq index.

Huang, who was born in Taiwan, has impressed investors with major developments, especially in Nvidia’s main product—graphics processing units (GPUs). These chips power many AI systems used in areas like self-driving cars, robotics, and other advanced technologies.

Sharp rise in Nvidia stock

Nvidia’s stock has seen a sharp and rapid riase in recent months breaking several records along the way. To give perspective, when Apple reached a $3 trillion valuation in early 2022, Nvidia’s value was only about $750 billion.

Earlier this week, analysts at Citi increased their price target for Nvidia from $180 to $190, a CNBC report said. They said this was due to a bigger-than-expected rise in demand for AI systems controlled and managed by individual governments. As more countries and large organizations invest in their own AI infrastructure, Nvidia is expected to gain significantly.