A liquor bill of a restaurant in Rajasthan has been going viral on social media. But why? Well, it levies cow cess among other taxes, including CGST and SGST. The tax, which was introduced in 2018 to support cows and cow shelters in Rajasthan, has triggered a debate online.

One user said, “As much as I want the welfare of cows (or all animals for the matter), I don’t understand the concept of cow cess.” Another said, “The irony is the Jaipur-Jodhpur highway, which is littered with cattle loitering on the road, making it extremely dangerous for commuters. Rajasthan govt is barely doing anything for the rehabilitation of cattle/cows.”

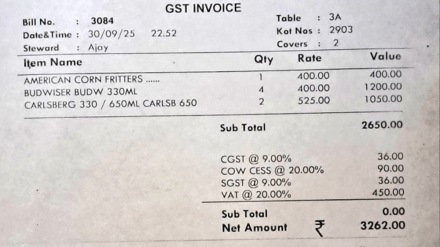

20% cow cess on liquor bill

The bill showed that the customer had ordered six beers and American corn fritters to munch on at Geoffrey’s bar on September 30. The order total was Rs 2,650, and after GST, VAT, and a 20 per cent cow cess, the net bill amount stood at Rs 3,262.

For those unaware, CGST and SGST are on fritters, while VAT is on liquor prices. The cow cess is levied on the VAT amount for liquor.

Rajasthan’s Finance Secretary (Revenue), Kumar Pal Gautam, explained that liquor served on tables is priced higher than the MRP. Because of this, it attracts an additional surcharge, referred to as the cow cess in the state.

“If a restaurant or a bar charges extra for a bottle of liquor, then they must pay VAT since there is value addition to the liquor sale, and with that, the cow cess is also charged,” the Finance Secretary was quoted by NDTV as saying.

The 20 per cent cow cess was introduced in 2018 by then CM Vasundhara Raje on liquor sold by dealers under the Rajasthan Value Added Tax Act, 2003.

‘Cow cess has been there since 2018,’ says hotel manager

The hotel manager, Nikhil Prem, said that the cow cess is not something new and has been levied since 2018 in Rajasthan for the protection and conservation of cows, NDTV reported.

“This government notification has been there since 2018,” the manager said, before explaining, “Every time we charge 20 per cent VAT, we charge a 20 per cent cow cess on the VAT amount, which would work out in this case to about 24 per cent. This is only for beer and liquor.”

He added, “Most hotels simply call it a surcharge, but we mention a cow cess. We deposit this money as a cow conservation and propagation cess on government portals.”

‘Is this for real?’: Social media users

One person, while sharing “food for thought” asked, “What’s the point of GST if other taxes are higher than it?”

Another social media user pointed out, “Haryana has cow cess as well, but still stray cows in cities.”

“Is this for real?” reacted a third.