The Import Monitoring Group (IMG), set up to detect early signs of dumping of products into India due to higher tariff walls in the US, will assess data for some commodities and products on a daily basis, while for some others, weekly data will be studied, sources said.

The IMG, anchored by the ministry of commerce and comprising department of revenue, will take on board other ministries when products under their administrative controls create cause of concern.

While any surges in imports will be handled with the laid-down protocols and the system of Directorate General of Trade Remedies, strict compliance of Quality Control Orders (QCOs), rules of origin (ROO) on imports from countries with which India has signed FTAs would be other tools at the government’s disposal.

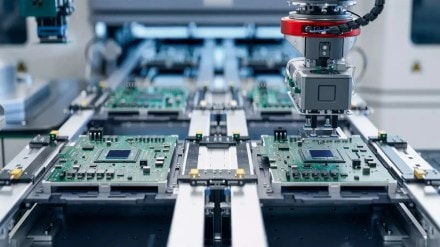

The 90-day pause in the full implementation of reciprocal tariffs and massive duty differential with China as it exists now could lead to a shift in overseas demand – particularly for electronics and smartphones – to India. This could result in higher imports of components and intermediate goods to meet that demand.

“Lots of imports that are used as inputs come duty-free using schemes like Advance Authorisation Scheme and the different regimes applicable for Export Oriented Units (EoU) and Special Economic Zones (SEZs). Probably those imports may be having soft examination and more focus will be on finished goods,” an industry official said.

Officials said the first rush of imports are expected in consumer goods which may later intermediate goods and raw material may also try to seek markets in India. Special focus will be on China and some other countries in Asia Pacific like Vietnam, Thailand and South Korea with whom Indian supply chains are more closely integrated.

On raw materials like steel the QCOs are expected to be a barrier to imports from China as no Chinese steel mill has been certified by Bureau of Indian Standards (BIS) for export to India.

While the dumping can be tackled with heightened vigilance, the industry expects that disruption in normal trade flows globally will intensify competition in other markets too. “The surpluses would be offloaded in the global markets at bargain prices making efforts to find new markets to bring down dependence on a handful of markets more difficult,” industry officials say.