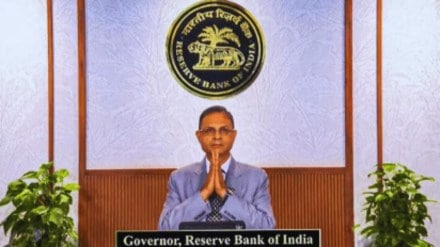

It is an early Christmas for borrowers. Friday’s 25-basis-point (bps) cut in the repo rate to 5.25% will lower borrowing costs for a large swathe of consumers and businesses. Equally important, the Reserve Bank of India’s (RBI) decision to inject about Rs 1.5 lakh crore of liquidity into the system should help accelerate the transmission of the rate cut into lower lending rates across banks and financial institutions. The Monetary Policy Committee (MPC) had sufficient room to act. Inflation averaged 2.2% in the first half of FY26—well below the 4% target and lower than projected. RBI Governor Sanjay Malhotra has indicated that price pressures are likely to remain contained. Core inflation is under control, and stripping out the surge in precious metal prices, retail inflation has been particularly benign. The central bank has also lowered its inflation projection for FY26 to 2% from 2.6%, while trimming its forecasts for Q1FY27 and Q2FY27 to 3.9% and 4% respectively.

Debate before the announcement

Opinion was sharply divided ahead of the policy announcement. Strong real GDP growth in the September quarter and the sharply depreciating rupee led many to believe the central bank would hold rates. The decision to cut suggests that the RBI is prepared to live with the currency weakening past Rs 90 to the dollar and is comfortable with current conditions in the external sector. The rate cut also reflects growing unease about the growth outlook. Economic momentum could weaken in the second half as the front-loaded boost from exports fades and government spending slows. Governor Malhotra acknowledged this, noting that while overall growth remains resilient, signs of strain are visible in some indicators. With no trade agreement in sight, exports are likely to continue struggling under the weight of elevated US tariffs.

RBI appears uneasy about nominal GDP growth

Moreover, headline GDP growth of 8% in April-September flatters reality; weaker deflators have magnified the real growth numbers. While the RBI has raised its FY26 growth forecast by 50 bps to 7.3%, it expects growth in the first half of FY27 to slip below 7%. The central bank also appears uneasy about nominal GDP growth, which at 8.7-8.8% has implications for fiscal arithmetic and corporate earnings alike. If inflation remains on track, another rate cut is possible. The neutral stance leaves the door open. A counter-cyclical policy push is timely and could help revive urban demand while sustaining rural consumption. That said, monetary easing takes time to filter through. Friday’s measures are growth-supportive, and the evolving growth-inflation mix keeps the door open for one more rate cut. A further reduction in February would not be unwarranted. Financial conditions should be supportive for rate transmission and for bond market sentiment.

Liquidity conditions should also improve meaningfully. The infusion of durable liquidity—through open market operations (OMO) and the $5 billion buy-sell swap—ought to ease funding conditions. It is essential that yields, particularly in the corporate bond market, soften to support investment. While benchmark yields initially dropped to 6.46% after the OMO announcement, they subsequently rose after the governor clarified that OMO purchases are aimed at supporting liquidity rather than managing yields. Still, intent matters. The RBI has committed to maintaining adequate liquidity at around 1% of net demand and time liabilities. It must now follow through. In the end, the effectiveness of this easing cycle will not be judged by announcements—but by how quickly cheaper money reaches those who need it most.