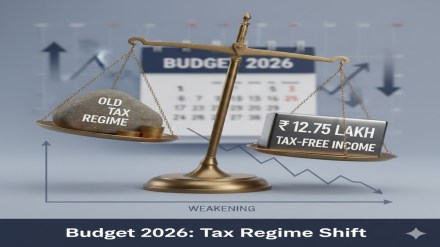

In the Union Budget 2025-26, when Finance Minister Nirmala Sitharaman made annual income of up to Rs 12.75 lakh effectively tax-free under the new tax regime, it was more than just a relief announcement for salaried taxpayers. In fact, it was a clear and strong message — the government wants taxpayers to gradually move away from the old tax regime, even if the Centre may not formally scrap it anytime soon.

Official data already shows that the government’s move has yielded desired results. Today, less than 20% of taxpayers remain under the old tax regime. The February 2025 Budget only deepened this divide, making the old regime look increasingly cumbersome and, for many, financially unattractive, despite retaining all the deductions and exemptions that were previously available.

Old tax regime: A silent shift, not a sudden exit

The government has not announced any plan to abolish the old tax regime. Instead, it has chosen a more subtle route — make the new regime so attractive and simple that the old one fades into irrelevance on its own.

This strategy became clear after Budget 2025, when the rebate under Section 87A was enhanced to Rs 60,000. As a result, total income up to Rs 12 lakh became tax-free under the new regime.

For salaried taxpayers, the standard deduction of Rs 75,000 pushed this practical tax-free threshold further to Rs 12.75 lakh.

For crores of middle-income earners, this single change has fundamentally altered the tax planning conversation.

Why traditional deductions are losing their edge

Under the old tax regime, tax saving was built around deductions and exemptions — Section 80C investments, home loan principal and interest, insurance premiums, HRA, LTA and more. Over the years, these deductions and exemptions shaped how Indians saved, borrowed and invested.

But as CA Dr. Suresh Surana explains, the new tax regime has changed that equation completely.

“From FY 2025–26 onwards, the enhanced rebate of up to Rs 60,000 under Section 87A ensures that total income up to Rs 12 lakh is effectively tax-free under the New Tax Regime. The introduction of nil effective tax up to Rs 12.75 lakh (Salaried taxpayers also get a Rs 75,000 standard deduction, pushing the practical tax-free threshold to Rs 12.75 lakh) has materially altered the relevance of traditional deductions available under the old tax regime such as Section 80C, home loan interest, insurance premiums, etc. particularly for middle-income taxpayers.”

In simple terms, a large number of taxpayers no longer need to chase deductions just to reduce tax liability. The tax itself has disappeared up to a fairly high income level.

Old regime still works — but only for a shrinking group

This does not mean the old tax regime is entirely redundant. It still offers substantial benefits, especially for those with high housing-related deductions.

However, the math has become tougher.

According to Dr. Surana, the old regime makes financial sense only if total deductions and exemptions cross roughly Rs 8.5 lakh. This includes home loan interest, principal repayment, Section 80C investments and other eligible benefits combined.

“While the old tax regime continues to offer substantial deductions especially for housing-related benefits it is financially advantageous only where the aggregate value of eligible deductions and exemptions crosses roughly Rs 8.5 lakh.”

For many salaried professionals, reaching such a high deduction figure is not easy unless they have a sizeable home loan and long-standing tax-saving investments. Those without housing loans or with limited deductions increasingly find the old regime ineffective.

Tax slabs tell the real story

A quick comparison of tax slabs shows why the new regime is winning favour.

New tax regime

| Annual income | Tax rate |

| Up to Rs 4 lakh | Nil |

| Rs 4 – Rs 8 lakh | 5% |

| Rs 8 – Rs 12 lakh | 10% |

| Rs 12 – Rs 16 lakh | 15% |

| Rs 16 – Rs 20 lakh | 20% |

| Rs 20 – Rs 24 lakh | 25% |

| Above Rs 24 lakh | 30% |

Note: Most deductions are not available under the new regime.

Effective tax-free income goes up to Rs 12.75 lakh for salaried taxpayers after standard deduction and rebate.

Under the new tax regime, slabs are lower and more evenly spread, and the rebate wipes out tax liability entirely up to Rs 12 lakh, which means there is no need to lock money into specific products just to save tax.

Old tax regime

| Annual income | Tax rate |

| Up to Rs 2.5 lakh | Nil |

| Rs 2.5 – Rs 5 lakh | 5% |

| Rs 5 – Rs 10 lakh | 20% |

| Above Rs 10 lakh | 30% |

Note: Deductions and exemptions like 80C, HRA, 80D, home loan interest are available under the old regime.

The old tax regime, on the other hand, still follows higher slab rates but compensates through deductions. As deductions lose relevance for average earners, the higher rates start to pinch.

In effect, the government has flipped the tax system — from “invest first to save tax” to “pay less tax by default.”

Policy intent is now hard to ignore

The Budget 2025 changes reinforce a long-term policy direction. The government wants a tax system that is simpler, cleaner and easier to comply with, even if that means dismantling decades-old tax-saving behaviour.

As Dr. Surana points out: “As discussed, the new tax regime has been significantly incentivised and it is expected that more and more people will switch / transition from the old tax regime to the new tax regime while filing their tax returns for Financial year 2025-26.”

This gradual migration also helps the government reduce disputes, simplify return filing and limit misuse of exemptions.

The road ahead: relevance versus nostalgia

The old tax regime still exists — and may continue to do so for a couple of more years. But Budget 2025 has made one thing clear: it is no longer the default choice.

With nil tax up to Rs 12.75 lakh, fewer deductions to track, and lower compliance stress, the new tax regime has become the obvious option for most taxpayers. The old regime is now largely for a niche group with high deductions, especially housing-related.

In that sense, Rs 12.75 lakh tax-free income was not just a tax relief announcement. It was a policy signal — the government wants the old tax regime to quietly step aside, without ever formally shutting the door.