After a taxpayer has completed efiling of his/her income tax return, the next important step is to e-verify the tax return as well. E-verification of income tax returns is the final step in the process and a very important one. The Income Tax Department will not process tax returns that have not been verified.

Returns that have been e-filed have to be verified electronically as well. Tax returns can be e-verified by any of the following three methods:

# Aadhaar number

# Netbanking account

# Electronic verification code

Steps to e-verify using Aadhaar

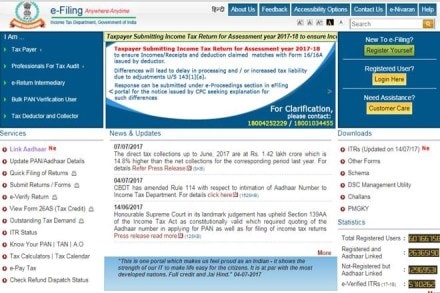

# Log in to your income tax e-filing account on the Income Tax Department’s website

# Select the option to generate Aadhaar OTP to e-verify

# An OTP will be sent to your Aadhaar-registered mobile number

# Enter this OTP to successfully e-verify tax returns

E-verifying your income tax returns by generating an Electronic Verification Code (EVC) is also to be done in the same manner. A code is sent to your registered mobile number that you have to enter to finish e-verifying your income tax returns.

Watch this video:

Steps to e-verify using Netbanking

# Log in to your netbanking account and locate the income tax e-filing tab

# Remember to log in to your bank account that is linked with the income tax department

# From the netbanking account, you will be taken to the department website

# Click on the View Returns/Forms option

# Click on the returns pending for e-verification

# Click on the option to e-verify

# Click on continue and generate an EVC code to finish e-verifying your tax returns

Watch this also:

Income tax returns that have been filed physically have to be verified as well. To do this, the taxpayer has to download the ITR-V from the tax department’s website and send it by post or courier to the Income Tax office in Bangalore.

(The author is Founder and CEO, ClearTax.in)