The Specialised Investment Fund (SIF) industry in India is expected to be Rs 15 lakh crore big by 2030, according to Andrew Holland, head of new asset class at Nippon India Mutual Fund.

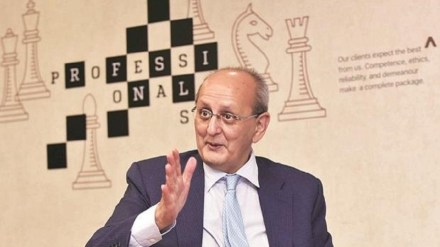

The fund house is planning to launch its first fund under this category in a month. The launches will similar to the absolute return and enhanced returns funds Holland used to manage at Avendus Capital. At a panel discussion at Morningstar Investment Conference on Tuesday, he noted the feedback being received from investors is two-pronged–Where do you position this product? And what are going to be my extra returns?

He explained: “We need to explain to investors is this risk curve, which at the bottom is obviously bonds, liquid funds, arbitrage, then you go to equity savings, large cap, big cap, small cap.

For a hybrid fund, you’re going to be stuck between equity savings or hybrid and bond arbitrage funds. And if you’re getting 300 to 400 basis points above those types of products, with taxation, which is mutual fund taxation, with minimal drawdowns and low risk, that’s where people are going to move.”

He added that a long-short equity fund, falls between large cap and your mid cap, which is protecting your capital. “So, it’s equity minus in terms of risk, but equity plus in terms of return. So you would be expecting, say, 200 basis points above NIFTY, that was your benchmark, on that type of a product,” he said.

Holland said, when they first launched a cat-III fund in 2013, they were consistently managing to return 12-14% gross on an annualized basis with very minimal drawdowns but after tax, which is 40%, they were reduced to 7-9%. He said: “So, one of the big game changers that SIF brings is non-taxation because obviously it’s a mutual fund. Therefore, if you can still deliver that 12 to 14% gross, then it’s 12.5% taxation.”

The second point he noted is that the ticket size is 10 lakhs, not 1 crore and if you go through the same mutual fund where they offer you different products or funds, then you can actually split that 10 lakhs between those funds. He said: “Taking these two into account, I think this is a product which investors will see more and more. I think the hurdles that we have to overcome is obviously education.”