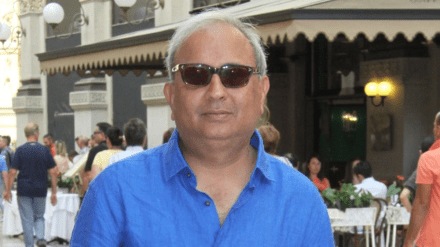

The IPOs are coming thick and fast and given the listing disappointment even in some big names, Helios Capital founder Samir Arora has shared his perspective on key points to remember when companies are preparing to go public. He explains that companies shouldn’t push for a listing if they know the next set of numbers will disappoint.

According to him, ‘many early stumbles are predictable and avoidable.’ A weak first quarter can drag the stock from day one, and he says it’s better to wait a little longer than walk into a setback.

The first quarterly earnings after listing crucial

“Make sure you don’t have bad results in the first quarter after IPO. That really upsets investors. Better to delay IPO by a few months if immediate results will be below expectations,” Arora posted on X.

He noted that mixing poor results with overly upbeat commentary creates confusion and needless market swings. When a company posts bad numbers but tries to sound positive on the call or flips the order, it leaves investors unsure of what to expect.

“If you are having bad results but you are going to talk super bullish in a conference call or vice versa, don’t keep one day between results and call and create unnecessary volatility in between.”

Damaging investor confidence not advisable, says Samir Arora

He added that companies must avoid issuing a glowing business update only to follow it with weaker results a few days later. That gap between tone and performance damages confidence quickly, and he says firms should rethink how they communicate if this keeps happening.

“If you are going to give a bullish quarterly business update and then disappoint with actual results a few days later, better rethink how to give a business update and not be seen as totally misleading.”

Arora’s message lands at a time when several recent listings have faced sharp corrections. Arora highlighted that mismatched messaging can create immediate turbulence. Companies are under pressure to manage expectations carefully, avoid overpromising, and ensure their updates line up with their numbers.