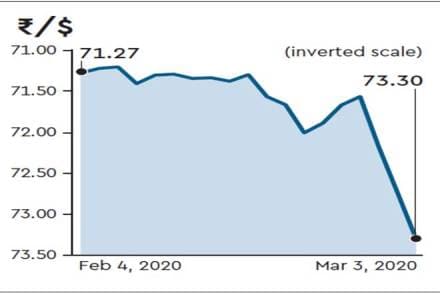

The rupee on Tuesday fell 57 paise to a 16-month low of 73.297 against the US dollar even as foreign portfolio investors (FPIs) continued to pull out funds from the Indian capital markets, eventually leading to a sharp decline in the rupee non-deliverable forwards (NDF) that accentuated the fall of the currency in the spot market. In last three sessions itself, the currency has depreciated by 173 paise. On Tuesday, most Asian currencies were trading lower against the US dollar.

Foreign investors have pulled out $3.5 billion from Indian equities and bonds on a net basis in the last six consecutive sessions. Indeed, the pull-out has led to some weakening in the currency. But what increased the pace of the fall recently is the action in the rupee non-deliverable forwards (NDF) market where the currency was getting hammered, mostly led by speculators, experts say.

Abhishek Goenka, CEO at IFA Global, pointed out that over the last three days, the spread between the rupee NDF and the onshore forwards have increased.

“What used to be a three to five paise spread, has gone up above 20 paise. Historically, in 2008, 2013 and 2018, whenever these situations occur, it is an indication of a short runaway. RBI has not been active in the markets lately but may come in when things typically look too brutal since they will risk heavy outflows in debt, in case rupee depreciates a lot,” Goenka said.

NDF markets enable trading of the non-convertible currency, like a rupee, outside the influence of the domestic authorities. For instance, trading in rupee NDF takes place in Singapore, Hong Kong, Dubai, London and New York markets. These contracts are settled in a convertible currency, usually US dollars. The one-month rupee NDF has fallen 181 paise over last four consecutive sessions.

Some experts also pointed out that although the RBI has issued a statement, it does not seem to be too worried about the fall in the currency. MV Srinivasan, vice-president at Mecklai Financial Services, said although fund flows have had an impact on the currency, the fundamentals at present are not against the rupee.

“It is true that FPIs have pulled funds out of equities and bonds but there is no fundamental reason that is leading to such sharp downfall in the rupee in recent sessions. The dollar is weak against some of the major currencies. Oil prices are also lower and you have huge Chinese imports that are going to be delayed. So, most of the macros are not against the currency. What I suspect is that the NDF market is triggering the downfall currently with speculators entering the scene after the recent fall in the currency. At present, it does not seem that the RBI is trying to break the fall in the currency. However, as soon as they do, we may see a sharp reversal,” Srinivasan said.

On Tuesday, the RBI issued a statement indicating that it is monitoring global and domestic developments closely and continuously and stands ready to take appropriate actions to ensure orderly functioning of financial markets, maintain market confidence and preserve financial stability.

Ananth Narayan, professor-finance at SPJIMR, believes that with the central bank sitting on record levels of currency reserves, it will likely step in to control excessive volatility in the short run, particularly in light of the comments offered. “To that extent, I would not expect a runaway rupee depreciation. However, in the medium run, with RBI continuing to accumulate reserves, with global uncertainties and an overvalued rupee, a depreciation of the rupee over time could be both likely and desirable,” Narayan said.