Gold prices steadied on Friday, having posted their biggest daily decline in two weeks in the previous session after robust U.S. economic data lifted the dollar.

FUNDAMENTALS

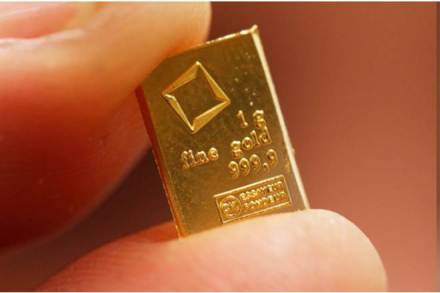

* Spot gold was up about 0.1 percent at $1,293.19 per ounce as of 0123 GMT, after slipping more than one percent on Thursday.

* For the week, gold is up about 0.1 percent, on track to eke out its first weekly gain in three.

Also read: Oil prices firm amid OPEC supply cuts, US sanctions on Iran and Venezuela

* U.S. gold futures gained about 0.3 percent at $1,296.60 an ounce. * The dollar held firm on Friday after strong U.S. labour and inflation data soothed concerns about the world’s largest economy, while falling oil prices weighed on commodity-linked currencies such as the Canadian and Australian dollars.

* The number of Americans filing applications for unemployment benefits fell to a 49-1/2-year low last week, pointing to sustained labor market strength that could temper expectations of a sharp slowdown in economic growth.

* U.S. producer prices increased by the most in five months in March, but underlying wholesale inflation was tame.

* U.S. President Donald Trump on Thursday expressed a willingness to hold a third summit with North Korean leader Kim Jong Un but said in talks with South Korean President Moon Jae-in that Washington would leave sanctions in place on Pyongyang.

* European Union countries gave initial clearance on Thursday to start formal trade talks with the United States, EU sources said, a move designed but not guaranteed to smooth strained relations between the world’s two largest economies.

* The six-month delay of Britain’s exit from the European Union avoids the “terrible outcome” of a “no-deal” Brexit that would further pressure a slowing global economy but does nothing to lift uncertainty over the final outcome, the head of the International Monetary Fund said on Thursday.

* Global silver demand rose 4 percent last year, chalking up its first increase since 2015 thanks to sharply higher consumption in India, with a supply fall creating a small deficit, an industry report said on Thursday.

* South Africa’s total mining output fell 7.5 percent year-on-year in February compared to a contraction of 3.3 in January, Statistics South Africa said on Thursday.