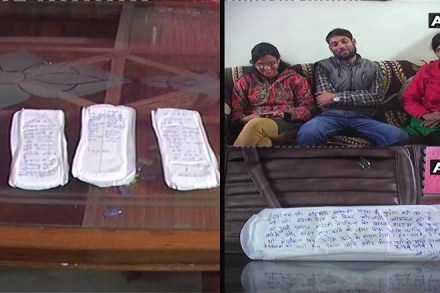

In a unique campaign, a group of social workers from Gwalior are sending 1,000 sanitary napkins to Prime Minister Narendra Modi to mark their protest against 12% Goods and Services Tax (GST) on the product. These social workers are encouraging women to write down their views on menstrual hygiene on sanitary napkins so that it is conveyed to the government. The campaign was launched on January 4 and has been spreading through social media.

Talking about this campaign, a student, Hari Mohan said that instead of giving subsidy on these products, the government has actually put them under luxury items. “Sanitary napkins have been placed under 12% GST. Women use things during their menstrual days which is fatal to them. Instead of giving subsidy, it has been placed under luxury item. So we started this campaign. We aim to send 1000 pads to the govt by 3rd March,” he said.

Another social worker Preeti Joshi associated with the campaign said that women in rural areas cannot spend Rs 100 on sanitary napkins and the latest move further discourages them. “We started campaign on 4th January. Women in rural areas can’t spend Rs 100 on sanitary napkins. This situation discourages them from using sanitary napkins all the more. They end up falling prey to diseases. Free napkin, at least GST free napkins, must reach women,” she said.

A few weeks ago, Finance Minister Arun Jaitley had defended the move to levy 12% GST on sanitary napkins by saying that it protects Indian manufacturers from foreign ones. Before the GST regime was implemented, several hidden taxes and duties led to Sanitary Pads having an effective tax of 13 per cent over the price. So that is already reduced to 12 per cent by bringing it under the GST, Jaitley had said.

The Finance Minister had said that since the manufacturing costs are cut, the benefit can be passed on to the customer in the form of lower base price. Removing the GST completely from the sanitary pads would result in loss of input credit to Indian manufacturers and would drive up manufacturing costs even further.