India and New Zealand have agreed to deepen economic partnership by concluding negotiations on a Financial Services Annex as part of the newly finalized Free Trade Agreement (FTA). The annex, announced by the Ministry of Finance, focuses on enhanced cooperation in banking, insurance, fintech, and digital payments, building on the overall FTA finalised on Monday.

Both the countries have committed to develop interoperable domestic payment systems and enable real-time cross-border remittances and merchant payments through integrated Fast Payment Systems.

Financial opportunities

This opens significant opportunities for Indian payment providers, leveraging India’s advanced digital infrastructure, including the Unified Payments Interface (UPI) and National Payments Corporation of India (NPCI) platforms, the Ministry of Finance said in a statement.

The ministry described the annex as a “forward-looking and balanced” framework that offers greater market access, regulatory transparency, and collaborative mechanisms to support financial institutions from both nations.

At present, only two Indian banks, Bank of Baroda and Bank of India, operate subsidiaries in New Zealand, with a total of four branches. In contrast, New Zealand has no banking or insurance operations in India, and no Indian insurers are present there. The agreement aims to bridge this gap by promoting bilateral investments, institutional expansion, and service delivery.

Additional provisions for joint effort

Additional provisions include joint efforts on financial innovation, such as sharing experiences from regulatory sandboxes for cross-border fintech applications. Indian financial entities will also be protected against discriminatory credit assessment practices in New Zealand, ensuring fair treatment comparable to domestic institutions.

India and New Zealand have also committed to support back-office operations and financial support services, which will enable cost-effective centralized functions in India, and is expected to boost growth in India’s IT, financial services, and business process outsourcing sectors.

The provisions also include that the two sides recognize each party’s right to maintain legislative and regulatory requirements concerning the transfer, processing and storage of financial information, and aims to facilitate financial service suppliers to establish cross-border digital operations while ensuring complete regulatory control over data sovereignty and consumer privacy protections.

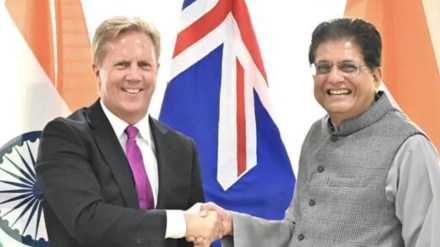

The broader FTA, finalized on Monday, includes a commitment from New Zealand for $20 billion in investments in India over 15 years, alongside zero-duty access for all Indian exports to the New Zealand market. Commerce and Industry Minister Piyush Goyal indicated the pact could enter into force by mid-2026 following legal processes.