At a time when investor Peter Thiel exited his Nvidia holdings, the chipmaker’s CEO Jensen Huang revealed a massive $500 billion in orders for 2025 and 2026, a sign that Nvidia believes the AI boom still has a long way to go.

The company has already seen its quarterly revenue jump nearly 600% over the past four years, but growth is expected to slow slightly as it enters its next generation of chips.

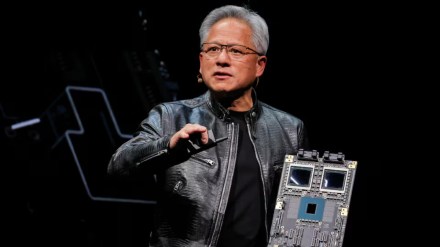

“This is how much business is on the books. Half a trillion dollars’ worth so far,” Huang said at the company’s GTC conference in Washington.

Huang said the $500 billion figure includes revenue booked for 2025 so far, sales of its current Blackwell chips, next year’s Rubin chips and other related products like networking gear.

After closely reviewing his remarks, analysts believe this signals a stronger-than-expected 2026 for the company.

“NVDA’s disclosures suggest clear upside to current consensus estimates,” Wolfe Research analyst Chris Caso wrote in November.

He estimated that Huang’s update could push data center revenue about $60 billion higher than Wall Street’s earlier 2026 forecasts. Caso has a buy-equivalent rating on Nvidia.

Yet despite the huge numbers, Nvidia’s stock is still trading about 5% below where it was when Huang made the announcement on October 28.

The market is still debating whether tech giants, known as hyperscalers are overspending on AI infrastructure or if demand will keep rising.

Nvidia results on Wednesday

Nvidia will report its third-quarter results on Wednesday. Analysts expect $1.25 earnings per share on $54.83 billion in revenue, a 56% jump from a year ago. They are also expecting the January quarter to come in at about $61.88 billion, which would point to growth picking up again.

The company typically gives guidance for only one quarter ahead, so investors will closely watch any comments Huang makes about its 2026 pipeline.

At the Washington conference, Huang said Nvidia has “visibility” into future revenue because almost every major tech company, Google, Amazon, Microsoft and Meta, is a customer.

Hyperscalers’ rising spending reflects “insatiable AI appetite,” Oppenheimer analyst Rick Schafer wrote earlier this month. He also has a buy rating on the stock.

Nvidia has been actively striking deals. The largest was its agreement to invest up to $10 billion in OpenAI in exchange for the startup buying 4–5 million GPUs over the coming years. The company also agreed to invest $5 billion in Intel to help Intel CPUs work better with Nvidia GPUs.

After the quarter ended, Nvidia bought a $1 billion stake in Nokia to integrate its chips into telecom hardware. The company has also continued investing in several startups.

Nvidia still controls more than 90% of the AI GPU market, but its biggest customers, including Amazon (Tranium), Google (TPU) and OpenAI (with Broadcom) have been talking more about their custom AI chips. Investors will be watching for Huang’s comments on this rising competition.

China uncertainty looms

None of these projections include China sales. Nvidia’s China-specific H20 chip was restricted earlier this year until Huang reached a deal with President Donald Trump in August to secure export licences in exchange for the US government receiving 15% of China sales.

Even with the agreement, Nvidia executives have sounded doubtful about achieving major sales in China. The company also has not revealed a successor to the H20, which is considered old by fast-moving AI standards. Schafer believes China could still be a more than $50 billion annual opportunity.