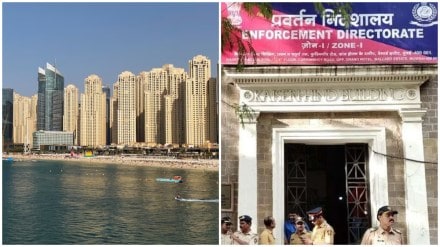

If you are someone who has bought a home in Dubai, then brace for scrutiny from the Enforcement Directorate (ED). The ED has sent out multiple summons to buyers who have bought homes in Dubai asking them to explain why there is no record of bank transfers, a report by Economic Times said. The report further added that most of the summons were issud in the north.

According to strict rules and regulations, money transactions over buying apartments or stocks and also booking Fixed Deposits with an offshore bank, need to be done via proper banking channels. The records need to be clear. ED is now acting on cases where the banks were not used for these transactions.

The I-T will be forwarding the data on this to the ED, post which it will determine the regulations that were violated under the Foreign Exchange Mangement Act (FEMA) and the Prevention of Money Laundering ACct (PMLA).

Who will face ED’s heat?

Anup P. Shah, partner at the tax and legal advisory firm PPS & Co., explained to Economic Times that the Enforcement Directorate is looking into several cases where payments were made using cryptocurrency transferred directly to builders’ digital wallets. He also mentioned instances where extremely wealthy individuals used high-limit credit cards to purchase properties or establish businesses in the UAE Free Trade Zones. According to him, such actions go against the rules laid out under the FEMA.

Shah explained that resident individuals are allowed to carry out such transactions only under the RBI‘s Liberalised Remittance Scheme (LRS), which requires sending money through an authorised dealer bank and completing all the required forms and declarations. Residential individuals can remit $250,000 a year under the LRS.

How did I-T department and ED crackdown on Dubai homebuyers?

Many people who bought homes in Dubai didn’t expect Indian authorities to find out because most global information-sharing agreements only include financial assets like bank accounts and stocks, not physical properties. However, their troubles with the Income Tax Department, and now the Enforcement Directorate (ED), began when I-T officials got access to the details about property ownership in the UAE. The report citing industry sources said that this information likely wasn’t officially shared by the UAE but was instead gathered by Indian officials stationed in Dubai and brought to India via a third country.

Regardless of how the information was collected, those who own these foreign properties are now being asked to explain where the money came from. under the Black Money law, if someone hasn’t declared a foreign property, they could be taxed and fined up to 120% of the property’s value. If the FEMA has been violated, then they may have to pay one to three times more in penalties.

People who used illegal ways like the hawala network to move money abroad and buy these properties could face action under the PMLA. In such cases, the property is seen as “proceeds of crime,” and there is no option to settle the case by admitting guilt and paying a fine. Authorities say that if the tax department makes a strong case under the Black Money law, it could also trigger an investigation under PMLA, which treats this as a serious criminal offence.