Earlier this week, Adani Group chairman Gautam Adani expressed optimism that the new-look Dharavi would be producing millionaires without the slumdog prefix. His fellow real estate developers have now endorsed that optimism. In a recent open letter, Adani had said each of Dharavi’s inhabitants would be relocated from the slum-dwellings to 400-square foot tenements, which would have water, power, piped gas, and a sewage-disposal system. Even ineligible tenants will be included in the rehabilitation plans.

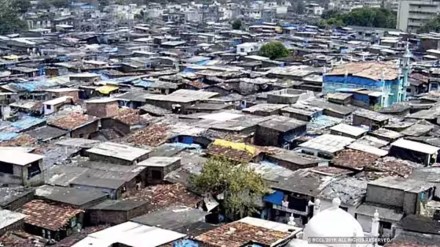

Top property developers and real estate experts said the Dharavi Redevelopment Plan could turn Asia’s largest slum, into a goldmine not only for its developer but has the potential to change the lives of people who live there without proper sanitisation and basic amenities. Last week, the Maharashtra government approved the Adani group’s proposal to redevelop the 590-acre Dharavi, home to over 900,000 dwellers, almost eight months after the conglomerate won the tender to develop the area.

Despite the complexity of the project as people of multi ethnicity live there and various types of small manufacturing and trading units operate in the area, other developers such as Sanjay Dutt, managing director and chief executive of Tata Realty & Infrastructure, sees the Dharavi redevelopment as a good business opportunity. He says that valuations in the surroundings area have gone up multi fold in the last two decades since the Dharavi project was envisaged. “If you recall , the neighbouring Bandra Kurla Complex was fetching Rs 10,000-11,000 per square feet for residential properties .Today they command Rs 65,000 per sq ft for luxury properties. Costs have gone up, but so has values, ” he says.

Dharavi is just 10 minutes driving distance from the tony financial hub of. After redevelopment, Dharavi would be an extended version of BKC, he says. A big advantage, Dutt says, is that the entire project would be developed by a single company, something that has never happened in India. This might lead to better coordination and development.

“Nariman Point was developed by Mittals, Makers and Rahejas; BKC by many developers whereas Dharavi is being redeveloped by a single developer who can decide where to do retail, office and so on,” he says. Mumbai, the country’s commercial capital, has often been for not having proper residential and commercial zones and hawking areas.

Niranjan Hiranandani, managing director of Hiranandani Group says that the project should take off quickly and become successful for the sake of the city. “Dharavi was pending for a dozens of years. It is not only good for the developer but also good for the city. The challenge is to develop the city.,” he says.

Shobhit Agarwal , managing director or Anarock Capital, a real estate focused investment banking firm, says that Dharavi was built in a different era when the country lacked resources. ”There are no proper sanitisation and hygiene , no formal economy in Dharavi. It was set up when we didn’t have money. But today we can develop it better and improve the lives of the people who live there. “

He, however, doubts whether it can be an alternative to BKC, which houses headquarters of some of India’s iconic companies and banks. “It (Dharavi) is a large and complex project. To get it auctioned it took two decades ” he says, adding that it is difficult to mirror BKC as the latter is earmarked for only offices and hotels barring a small percentage for residential properties. “Many commercial complexes came near BKC but nobody could match it. ” he adds.

Pushpamitra Das , founder of real estate marketing firm Justo Realfintech says Dharavi redevelopment is a fantastic proposition if cultural and religious differences are taken care of. “There are temples, mosques and churches in the area. People are trading there and staying there for decades. So a sensitive redevelopment plan is crucial for the success of the project,” Das said.

He adds that since it’s a capital intensive and long gestation project, only a large corporate such as Adani could fit the bill. “Most property developers are starved for cash,” he says, adding that foreign funding including sovereign funds, ADB , IFC who are committed to develop the developing nations , could help the project.