Quick commerce, with its hyperlocal and rapid deliveries, is set to make a mark in the food delivery space in India, stated a report by GlobalData. The urban, young, and educated Indian demographic is tech-savvy and is more inclined to get food delivered to the doorstep and avoid the hassle of going to a restaurant and underlining this trend, per a consumer survey by GlobalData, 64 per cent of respondents stated that they choose food delivery at least once a week.

Factors like busy lifestyles, longer travel times due to traffic, convenience of food delivery, and the desire to avoid heat, pollution, and large crowds have contributed to the growth of the q-commerce trend. Neralla Rama Ravi Teja, Consumer Analyst at GlobalData, said, “The COVID-19 pandemic amplified consumers’ tendency to order food online. However, given the increasing traffic and the wide selection of foodservice outlets, food delivery times are increasing.” However, to address the issue, players like Zomato started a quick delivery model for select foods in the past, but with a limited menu. “To fill in the need for quicker food deliveries, Swish, a Bengaluru-based company, unveiled a new food delivery platform that aims to bring the agility and rapid turnaround times of q-commerce to the food delivery space,” he added.

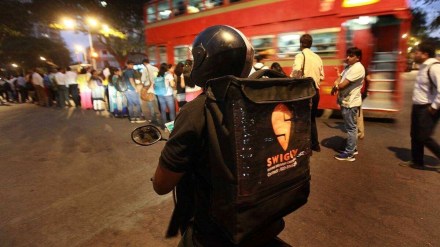

Francis Gabriel Godad, Consumer Business Development Manager, GlobalData India, said, “The Indian food delivery space is highly competitive, with Swiggy and Zomato dominating consumers’ minds. These established players have strong partnerships with restaurants and cloud kitchens and attract consumers with regular discounts and promotions. To carve out a space for itself in this competitive landscape, Swish needed a radical proposition. It expects its 10-minute delivery to help it rapidly penetrate the Indian market.”

Swish, the report stated, draws inspiration from the growing consumer acceptance of q-commerce providers, such as Blinkit and Zepto, with a similar proposition of grocery delivery within a few minutes. In June 2024, Zepto announced raising a funding of $665 million, which underscored investors’ belief in the company’s value proposition and the consumers’ affinity for q-commerce.

Neralla Rama Ravi Teja added, “Indian consumers seek high value for their money and are on the constant lookout for options that offer the best value. Swish aims to differentiate itself by offering value in terms of time, as modern-day young consumers are willing to spend extra money to save time. The company is presently operational in Bengaluru and plans to expand to other urban agglomerations.”

Francis Gabriel Godad concluded, “Cooked food needs preparation time to meet individual consumer preferences. The preparation of some items can start from scratch only after receiving an order. Q-commerce delivery may struggle to address consumers’ concerns over the quality of food that is made and delivered within 10 minutes. Some consumers are sceptical about restaurants using stale, pre-cooked food items, and not following proper procedures. In addition, there are concerns over the safety of delivery personnel, who may resort to rash driving to deliver food quickly, resulting in accidents and threatening their lives.”

According to a report by Redseer, q-commerce is projected to reach a market size of $6 billion by FY 2025, with expected growth rates of 75-85 per cent. This surge is driven by the addition of about 5 million new Monthly Transacting Users (MTUs) and a projected 20 per cent increase in spending per MTU.

Further, quick commerce is also trying ways to cut delivery times even further. Per industry predictions, by 2027, around 30 per cent of all quick commerce deliveries in major cities will be conducted by drones. This is because drone deliveries offer massive benefits to quick commerce businesses. “For quick commerce players, drones can cut delivery times by up to 50 per cent, slashing costs by 30 per cent,” Rohan Dani, Investment Professional, BlackSoil had told FinancialExpress. As per analysts, the operating costs for a drone delivery service are 40 per cent to 70 per cent lower than a vehicle delivery service model.