In a significant stride for the IT and electronics sectors, the India-UK Free Trade Agreement (FTA) provides a three-year exemption from social security payments for Indian professionals temporarily posted in the UK. The move will benefit around 75,000 Indian workers and over 900 employers, primarily from the IT sector, which counts the UK as its second-largest export market. This exemption is a major cost-saving measure for IT majors like Tata Consultancy Services and Infosys, and it eliminates a longstanding burden of dual contributions, allowing for more agile deployment of talent to onsite UK projects.

India-UK firms to avoid social security payments

The exemption falls under the double contribution convention (DCC), a framework that enables Indian and UK firms to avoid mandatory social security payments for employees on assignments of up to 36 months. For the $283-billion Indian IT industry, 17% of whose exports are UK-bound, this offers an operational edge and greater ease in servicing clients in the region. Alongside improved mobility, the agreement enhances India’s stature as a global technology partner.

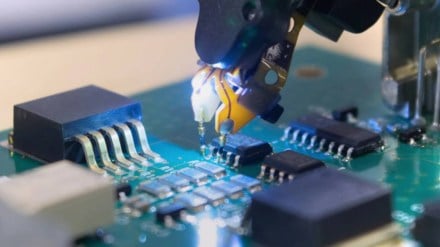

Big push for Indian electronics exports

Complementing the workforce mobility benefits is a robust push for Indian electronics exports. Under the FTA, Indian products like smartphones, optical fibre cables, and inverters will now enter the UK market duty-free. This zero-duty access is poised to accelerate shipments and strengthen India’s presence in a high-value, tech-savvy market. Industry officials expect the tariff cuts to significantly increase the competitiveness of Indian electronics, paving the way for deeper trade linkages in advanced hardware sectors.

From a strategic standpoint, the FTA not only secures immediate fiscal advantages for IT and electronics firms but also positions India more competitively in the global supply chain, particularly in tech-driven sectors.

As services and goods flow more freely across borders, the India-UK pact marks a key shift in trade dynamics, offering Indian companies a dual advantage of reduced costs of doing business in the UK and expanded market access for high-value exports.