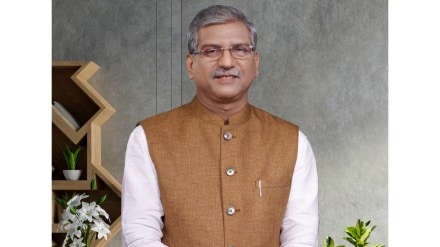

ESAF Small Finance Bank is recalibrating its lending strategy to focus on secured, retail asset-led growth, while gradually reducing its exposure to the microfinance segment. MD & CEO K Paul Thomas speaks with Narayanan V about the rationale behind this strategic pivot, the bank’s diversification efforts, and its outlook for credit and deposit growth in FY26. Edited Excerpts:

Your loan growth was almost flat in FY25. What led to the slowdown?

Our loan book remained largely stable at ₹19,643 crore as of Q4FY25, compared to ₹19,659 crore a year earlier. This muted growth was mainly due to a sharp reduction in our microfinance portfolio, which continues to face stress.The microfinance book declined to ₹9,705 crore in Q4FY25 from ₹13,764 crore in Q4FY24. The new guardrails introduced by the microfinance self-regulatory organisation (SRO) significantly reduced the pool of eligible borrowers. In several cases, we couldn’t extend fresh loans even to existing customers. As a result, disbursements in the microfinance segment dropped to ₹1,044 crore in Q4FY25 from ₹3,076 crore a year ago. Consequently, the share of microloans in our overall portfolio declined from 70% to 49% year-on-year.

What caused the shift in your asset mix?

The positive takeaway is the strong momentum in our secured loan portfolio. As of March 2024, secured loans accounted for 53% of our book, up from just 30% a year ago. Over the last five years, our secured loan book had been growing at a modest 5% annually. But in the past year alone, it grew 23%.This growth has been led by gold loans, which now comprise nearly 30% of our total portfolio. These are retail, branch-led products, and with our network of 787 branches across 26 states, we’re well-positioned to scale this further. We expect the share of gold loans to rise to 40% in the near term, before stabilising between 25–30%.Other secured products—such as mortgage, agriculture, and mobility loans—are also gaining traction. In Q4FY25, 85% of our disbursements, totaling ₹6,878 crore, were secured loans. Going forward, we aim to grow the secured loan portfolio by 5–7% annually. Over the next 3–4 years, we aim to bring down the share of unsecured loans from 47% to 30%.

When do you expect the stress in the microfinance segment to ease?

Having been in the microfinance sector for over 35 years, I’ve seen several stress cycles—but this one has been particularly prolonged. That said, we’re now seeing collection efficiencies returning to pre-stress levels, around 98–99%. The major slippages seem to be behind us, and with the self-regulatory organisation’s (SRO) new guidelines in place, there is greater discipline across the ecosystem. All member banks and MFIs are adhering to these norms.We are hopeful that by September, the stress will largely subside. We’re already seeing signs of recovery—borrowers, including some defaulters, are beginning to repay, even if only one or two installments at a time. They’re staying engaged and asking for time, which is encouraging.To support recovery, we’ve stepped up our efforts through our business correspondent partners and have increased our on-ground presence.

Are you facing any challenges in raising deposits?

Not at all. Our total deposits grew 17.2% in FY25 to ₹23,276 crore. Our strong network and brand trust in Kerala have played a significant role. About 20–25% of our deposits come from non-resident Indians (NRIs), which has been a key contributor.Not really. Our total deposits grew by 17.2% to ₹23,276 crore in FY25. Our strong network in Kerala has played a key role in this growth. Around 20–25% of our deposits come from non-resident Indians (NRIs), which has been a key contributor.Currently, 93% of our deposits are retail, with nearly 30% from senior citizens. South India contributes 86% of our total deposits and houses 61% of our banking outlets. However, we are actively working to diversify our liability base by expanding in northern and western India. The focus is on mobilising small-ticket retail deposits.To further our reach, we plan to open 30–35 new branches this year.

What is your credit and deposit growth outlook for FY26?

We expect our advances to grow by 12–15% in FY26. On the deposit side, we’re in a comfortable position and anticipate a growth of around 15–17%. Our aim is to maintain a balanced approach between credit and deposit growth. In fact, excess liquidity can also become a challenge, so we’re focused on ensuring that both sides of the balance sheet grow in tandem.