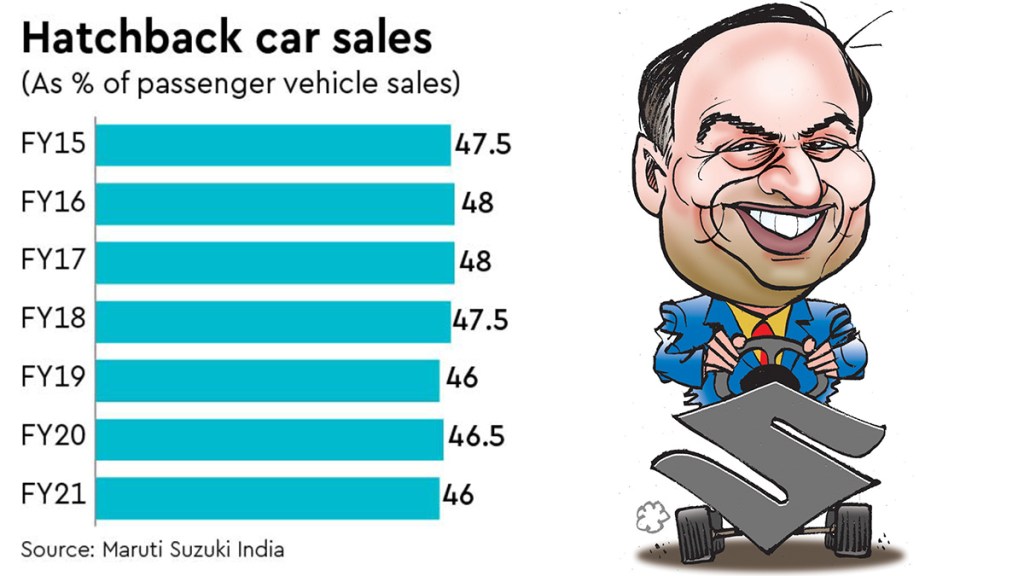

Over the last five years, the sales share of SUVs in the Indian passenger vehicle (PV) segment has grown from about 14 per cent to 32 per cent. “But they are taking market share from sedans, not hatchback cars,” says Shashank Srivastava, senior executive director, Marketing & Sales, Maruti Suzuki India. “Data shows that the sales share of hatchbacks has been constant (at 46-48 per cent) since FY15,” he tells FE’s Vikram Chaudhary. Excerpts:

Is India really turning into an SUV market?

One thing is clear that the sales share of SUVs has been rising. In FY21, the share of SUVs was 32 per cent in the PV segment, growing from about 14 per cent in FY15. But as far as hatchback cars are concerned, their share has remained constant at 46-48 per cent since FY15. So, India is still primarily a hatchback car market.SUVs are growing at a CAGR of 13.4 per cent over the last five years, which is impressive, but they have taken the market share from sedans, not hatchbacks.

The consumer preference towards SUVs is not an India-specific phenomenon, it is happening across the world. We have found that it plateaus at about 45% per cent.

How have been hatchback car sales over the years, for the industry?

In FY15 it was 47.5 per cent, in FY16 it was 48 per cent, in FY17 it was 48 per cent, in FY18 it was 47.5 per cent, in FY19 it was 46 per cent, in FY20 it was 46.5 per cent, and in FY21 it was 46 per cent.

The sales share of sedans was about 23 per cent in FY15-16, but which has now dropped to about 9.5 per cent.

With some carmakers launching entry-level SUVs, directly in competition with premium hatchbacks like the Baleno, do you think SUVs will take market share from hatchbacks as well in the near future?

The sales share of premium hatchbacks has remained constant over the years. For example, in FY15 their share was 21%, in FY16 it was 22 per cent, in FY17 it was 22 per cent, in FY18 it was 23 per cent, in FY19 it was 23 per cent, in FY20 it was 24 per cent, and in FY21 it was 24 per cent. So, entry-level SUVs are taking the sales share from sub-4 metre sedans, instead of premium hatchbacks.

Has the sales share of sub-4 metre sedan segment plateaued?

A sharp decline in the sub-4 metre sedan segment happened over the last two years and one of the reasons could be (in addition to consumer preference towards SUVs) that the fleet segment dropped dramatically after the lockdown (as people started moving away from shared mobility, and sub-4 metre sedans are very popular in the fleet segment).

How much has the sales share of diesel cars dropped after Maruti Suzuki exited the diesel segment with the implementation of BS6 emission norms from April 1, 2020, onwards?

In FY19 the sales share of diesel cars was 36.5 per cent, but this dropped to 29.5 per cent in FY20 when Maruti Suzuki exited the diesel segment, and in FY21 it dropped further to 17.2 per cent. In the first few months of this financial year it has plateaued at about 17 per cent and will change depending on who moves out of diesel.

Is diesel being replaced by CNG in the entry-level PV segment? Also, why do Maruti Suzuki CNG models currently have a waiting period of about four months?

We are able to supply 22,000-25,000 CNG cars every month at the moment; we have 1.1 lakh pending payments for CNG cars and that is why this waiting period. We have eight CNG models, and enjoy 85 per cent market share in the CNG segment. We are planning to add more CNG cars, including the new Celerio CNG, and are going at an annualised rate of 2.5 lakh CNG cars this year, up from 1.05 lakh in FY19 and 1.62 lakh in FY20.

The demand for CNG cars is rising because of two reasons. One, the running cost of CNG (about Rs 1.7 per km) is much lesser than petrol or diesel (about Rs 5 per km). Two, the number of CNG stations has increased; there were 1,500-odd CNG stations in about 150 cities four years ago, now there are 3,500 in about 250 cities, and in a few years the expectation is there will be about 10,000 CNG stations covering 330 cities. This gives confidence to the customer as well.

A sub-4 metre sedan can theoretically take CNG cylinder easier (and out of sight) compared to an SUV (the boot, where usually the cylinder is placed, is separate in a sedan, unlike in an SUV where the boot is part of the cabin). With CNG cars becoming popular, can the sales share of sub-4 metre sedans rise?

Yes that can be a design advantage for a sedan. Once we have a factory-fitted Dzire at some point of time, then obviously that market can go up. We moved out from the diesel engine in the Dzire and that also led to the sales share of sub-4 metre sedans dropping, but if it is replaced with CNG, sales can shoot up, especially in the fleet segment.

In CY21, Maruti Suzuki exported more than 2 lakh cars, its highest ever. When there is such a high demand for cars within India, why are you exporting? Is it because of prior commitments?

We have to be and are a part of the Make in India strategy; exports are a very important contribution for the overall economy and the growth of the country.

Hatchback car sales

(As percentage of overall passenger vehicle sales)

FY15: 47.5 per cent

FY16: 48 per cent

FY17: 48 per cent

FY18: 47.5 per cent

FY19: 46 per cent

FY20: 46.5 per cent

FY21: 46 per cent

(Source: Maruti Suzuki India)