Passenger vehicle sales in January continued to be impacted by the shortage of semiconductor, while two-wheelers face depressed demand due to rise in ownership cost as well as high fuel price.

According to the data released by industry body Society of Indian Automobile Manufacturers (Siam) on Friday, overall sales across categories fell 18.84% year-on-year (y-o-y) to 14,06,672 units in January.

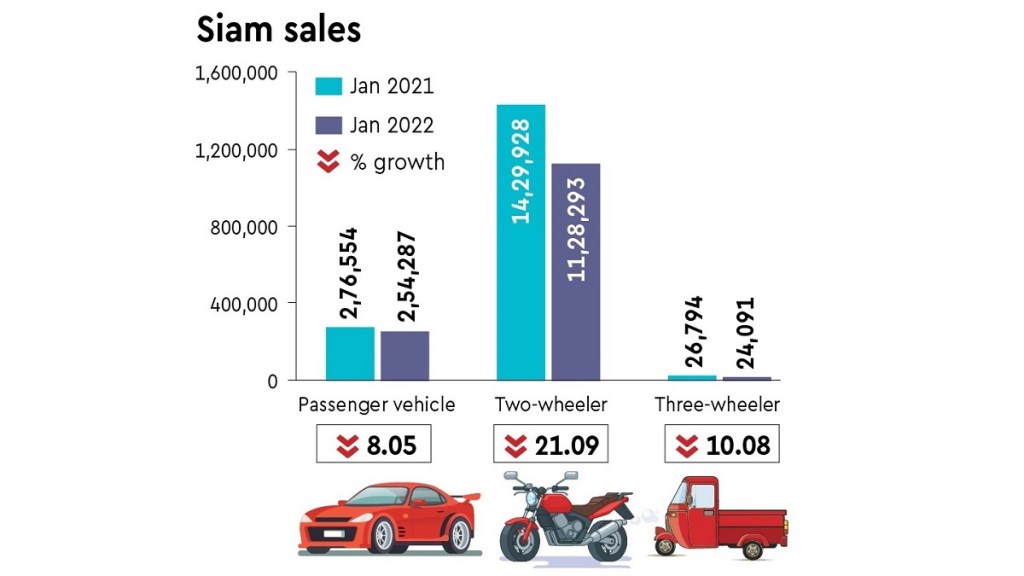

While PV sales declined 8.05% y-o-y to 2,54,287 units in January 2022, on a month-on-month basis, there was some improvement with a jump of 15.89%. This was on the back of higher production during the month — 2.14% over January 2021 and 13.17% over December 2021.

Within PVs, sales of passenger cars and vans slipped 17.32% y-o-y and 10.02% y-o-y, respectively, while utility vehicles witnessed a rise of 4.90% y-o-y.

“With a decline of 18.8% y-o-y in overall vehicle sales, the semiconductor shortage impact and the Omicron-related lockdowns impact is clearly visible. Passenger vehicle sales witnessed a dip of 8% y-o-y, however, there is an increase in sales number on m-o-m basis to 2,54,287 units in January 2022 from 2,19,421 units in December 2021, indicating ease of waiting period,” Saket Mehra, partner and auto sector leader, Grant Thornton Bharat, told FE.

“The decline in wholesale figures of the auto industry indicates that the economic recovery has not percolated down to the people, the majority of the rural market is suffering from prolonged economic distress and there is still a lack of confidence to make big-ticket purchases. The fall in PV sales is relatively less compared to other categories and even that is due to production constraints caused by semiconductor shortage, otherwise, demand appears to have bounced back,” said Suraj Ghosh, associate director, IHS Markit.

Lower consumer demand resulted in the wholesale despatches of 2Ws slipping 21.09% y-o-y to 11,28,293 units. The sales of scooters, motorcycles and mopeds fell 23.29%, 18.83% and 39.35% respectively on a y-o-y basis.

In the entry-level scooter segment (up to 125 cc), the sales dropped 23.55% y-o-y to 3,45,097 units, while there was a 13.31% y-o-y decline in the entry-level motorcycle segment (up to 125 cc) to 5,89,341 units.

Ghosh noted that the key addressable customer segments in the 2W category, such as the rural, tier 2, and urban commuter segments, have to be economically complemented as the impact of the pandemic and pandemic-related duress has been the highest.

“Unless this is resolved, the 2W sales may not return to their pre-pandemic levels any soon,” he said.